Welcome to the 10th edition of our small-cap coverage. Today, we're diving into a company that gives you chills, literally, “Symphony Ltd.”. Let's start! But before we do, here is the link to the 9th edition.

We post a new edition every 2nd Saturday. So Subscribe and stay tuned for our upcoming publications on various companies.

1. Company Share Price chart & comparison with Index:

Comparison with NIFTY50

Comparison with NSE SMALLCAP50

All above charts are *Indexed on 08 November 2023 (=100)

2. About Company:

Symphony Limited, based in India, is a leading manufacturer of energy-efficient air coolers for residential, commercial, and industrial use, with a strong global presence. Founded in 1988, it focuses on innovative cooling solutions for hot climates.

Basic key points:

Registered Name: Symphony Limited.

Establishment: 1988.

Products: Energy-efficient air coolers for residential, commercial, and industrial use.

Industry: Consumer Durables.

Listed on: Both NSE and BSE.

Website: https://symphonylimited.com/

3. Company Turnaround

In the past financial year, Symphony Limited reached a pivotal moment, achieving a significant turnaround in its global operations. In FY 2022-23, the company reported a Profit Before Interest and Tax (PBIT) of ₹190 crores from Indian operations and a negative ₹28 crores from global operations. However, in FY 2023-24, the global PBIT turned positive, reaching ₹1 crore, marking a notable shift from the previous year’s losses.

This turnaround was driven by focused market growth strategies, stringent cost management, and major business transformations at subsidiaries such as Climate Technologies in Australia. Each global subsidiary also demonstrated improved performance, regaining momentum that had been interrupted by the pandemic. Symphony remains dedicated to furthering this positive trajectory, with a strong commitment to sustained profitability and growth.

Detailed Performance Analysis

1. IMPCO (Mexico): In FY 2023-24, IMPCO in Mexico reached record-breaking results, achieving its highest-ever annual and quarterly revenue across all four quarters. Revenue surged by 51%, EBITDA grew by 223%, and PAT (Profit After Tax) skyrocketed by 454%. Notably, IMPCO’s first-quarter EBITDA surpassed that of Symphony's Indian operations, showcasing substantial growth and resilience.

2. GSK (China): GSK showed a strong year in FY 2023-24, with revenue growth of 36% and an all-time high annual EBITDA of ₹5 crores, a significant shift from the previous year's negative ₹0.1 crores. Additionally, GSK achieved profitability for the first time since its acquisition, reporting a PAT of ₹0.4 crores. This was driven by a review and optimization of its costs, alongside a strategic shift toward producing large industrial coolers—a niche market with less competition and high demand, especially after U.S.-China trade tensions affected smaller customer orders. GSK has also strengthened its role as a reliable internal supplier within Symphony’s supply chain.

3. Climate Technologies (Australia): Climate Technologies is currently undergoing a substantial transformation focusing on:

- Transitioning from in-house production to an outsourced model,

- Redesigning and expanding product categories,

- Optimizing gross margins and reducing operational costs, and

- Enhancing its distribution network.

Each of these subsidiaries has contributed to Symphony's positive performance, aligning with a broader strategy of profitability and growth across diverse geographic and market segments.

Several factors contributed to Symphony’s visible turnaround in performance:

Rise in Personal Incomes: Economic growth, with the GDP reaching 8% in some quarters, led to an increase in consumer incomes, boosting purchasing power and sales.

Shift to Premium Products: As consumer preference shifted from low-cost products to premium options, Symphony’s positioning in the high-end segment allowed it to outpace competitors.

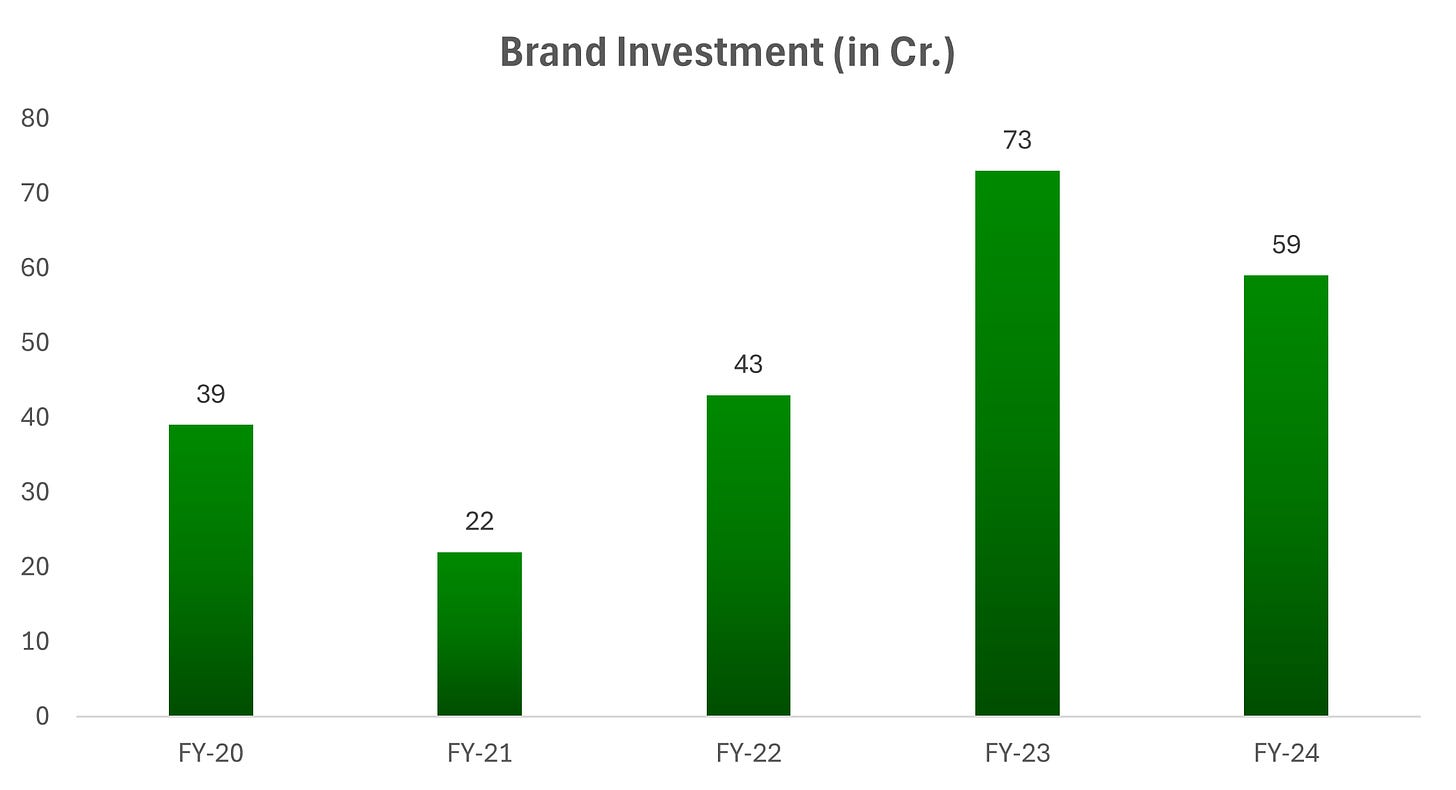

Effective Brand Campaigns: New brand campaigns resonated well with customers, enhancing Symphony's market presence.

Favorable Weather Conditions: The hotter-than-usual summer in 2024 heightened demand for cooling solutions, benefiting Symphony’s sales.

Enhanced Supply Chain Presence: Symphony increased its visibility in modern trade formats like large stores, e-commerce, and direct-to-consumer channels, reaching a wider audience.

Expanded Product Range: By introducing new products, including the successful Mastercool range, Symphony catered to a broad range of consumer needs and addressed gaps in the market.

Efficient Warehousing: The addition of two mother warehouses improved Symphony’s inventory management, reducing response time and transfer costs.

Broadened Channel Partnerships: By expanding its network, Symphony increased its modern trade market share, positioning it ahead of competitors in distribution reach.

These factors combined to strengthen Symphony's market position and drive a significant performance turnaround.

A. Symphony’s Operations and Market Reach

Operations

- Domestic Focus:

Presence: Symphony has a significant presence in India with 26 locations, comprising one manufacturing plant and 25 offices.

Primary Market: With the extensive domestic network, Symphony prioritizes the Indian market, likely making it the primary revenue source.

- International Reach:

Global Operations: The company operates in six international markets but maintains only two overseas offices, indicating a focus on streamlined operations.

Lean Expansion Model: Limited physical office presence overseas suggests that Symphony might rely on local partnerships and distributors to manage sales and distribution, ensuring cost efficiency.

Export Contribution: Exports account for 8% of total turnover, marking international sales as a valuable, though still relatively small, revenue stream.

Customer Base

- Diverse Segments Served: Symphony caters to various customer segments, including households, commercial clients, and industrial markets, diversifying its revenue sources.

- Strong Distribution Network:

Channels: Leveraging a comprehensive distribution network of distributors, dealers, e-commerce platforms, and retail outlets enables Symphony to reach a broad customer base.

Customer-Centric Approach: This multi-channel approach underscores Symphony’s commitment to accessibility and customer satisfaction.

B. Distribution Network

- Primary Reliance on Dealers and Distributors:

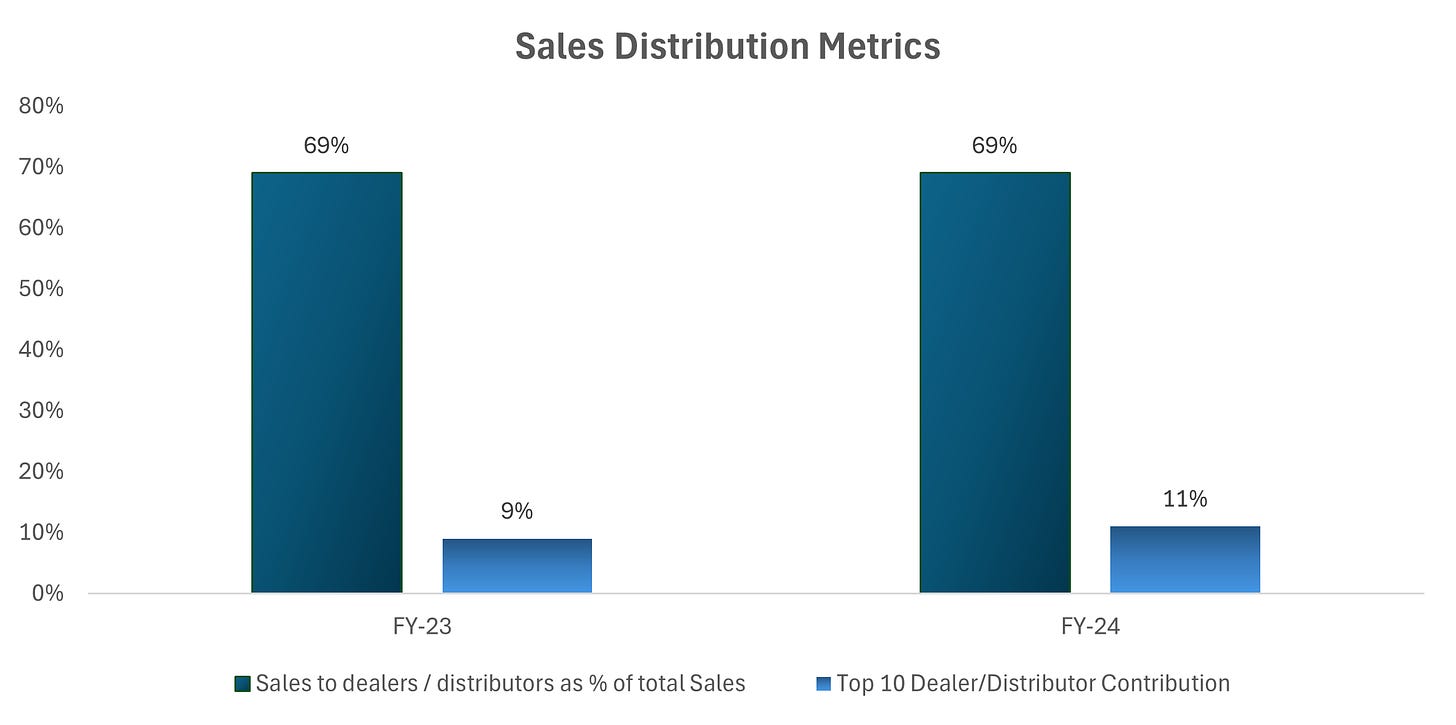

- Sales Composition: Approximately 69% of total sales in both FY23-24 and FY22-23 were through dealers and distributors. This high percentage reflects Symphony’s established reliance on an intermediary-based distribution strategy, which supports extensive market reach.

- Distribution Network Scale:

Dealer and Distributor Count: With ~1,000 dealers and distributors, Symphony benefits from a wide distribution footprint. This enables the company to penetrate multiple regions, catering to a diverse customer base.

- Diversified Sales Among Distributors:

Sales Concentration in Top 10 Customers: Although there is a large number of dealers and distributors, the top 10 only contributed 11% of sales in FY23-24 and 9% in FY22-23. This low concentration indicates that Symphony is not dependent on any single dealer or distributor, thereby mitigating risk and enhancing market resilience.

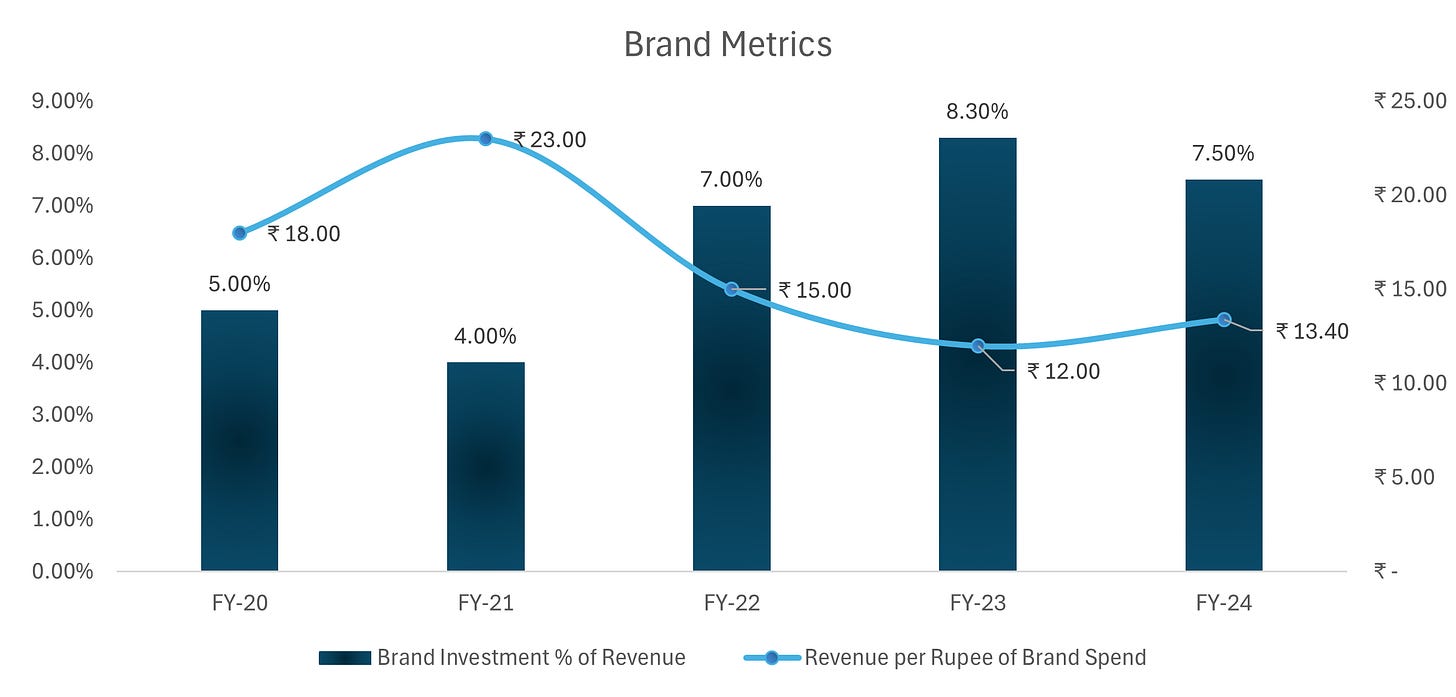

C. Symphony Brand Report

Overview

- Global Leadership: Symphony is the world’s leading air-cooler brand, maintaining its position amid rising competition. It remains the most preferred brand in India, recognized for its trustworthiness, innovation, and superior price-value proposition.

Metrics

Sectorial Context

- Market Demand: Increasing global temperatures have boosted the demand for environmentally friendly cooling solutions.

- Rural Opportunity: With 64% of India’s population in rural areas, the air-cooler category has significant untapped potential. Currently, penetration rates stand at 25% in urban and 16% in rural areas.

- Growing Middle Class: India’s middle-class households are projected to double by 2047, representing a substantial future market.

Symphony Brand Strengths

- Strong Brand Recall: Symphony is synonymous with air coolers, known for its value and wide market reach.

- Market Leadership: Symphony holds approximately 50% market share by value in India’s organized air-cooler sector.

- Innovation and Product Development: The brand consistently drives innovation, introducing 17 new models in FY 2023-24, with recent models contributing over 60% of the fiscal year's revenue.

4. Performance review- India Business

Household Coolers

Season Overview: The year started slowly due to unfavorable summer conditions in many regions of India.

Strategic Realignment: Adjusted the entire product range for better market collection and corrected prices based on market dynamics and segment analysis.

Growth Initiative: Launched the Symphony Ka Mahotsav (SKM) program with an 'Inner Circle' concept, featuring a tiered structure for channel partners.

Market Penetration: Focused on expanding product reach in rural areas and tier III/IV towns by acquiring new channel partners, resulting in significant growth in these regions.

Direct to Consumer (D2C)

D2C Platform: Symphony’s D2C channel is a key component of its business model, allowing direct connections with consumers in the digital age.

Customer Engagement: The platform facilitates fast and personalized interactions via emails, texts, and live chats, enabling immediate response to consumer trends.

Operational Efficiency: Symphony's D2C model features a fully prepaid system with minimal cancellations and returns, distinguishing it from typical D2C models.

Online Store: The online store highlights superior cooler offerings while maintaining high standards of customer care and satisfaction.

E-commerce

Comprehensive Alignment: Achieved alignment across various platforms with strategic advertising modules, including Search and Display.

Sponsorships: Symphony became the title sponsor for the 'Cooling Days' events on both Amazon and Flipkart.

Integrated Marketing: Combined offline and online marketing efforts, highlighted by a notable SB video on Amazon and “India ka No. 1 Cooler” banners.

Product Promotion:

- Emphasis on promoting Surround tower fans.

- Expansion of the tabletop range with new models: 'Buddy' and 'Duet Mini'.

- Positive market response for Surround and Tabletop (TT) ranges, particularly for the Duet Mini's spot cooling feature.

- First-time listing of the Movicool range on e-commerce platforms.

Large Space Venti Cooling (LSV)

Growth Trajectory: The LSV division continued to drive growth by raising awareness about industrial and commercial coolers across diverse customer segments and micro-locations.

Export

Middle East Growth: Significant growth in the Middle East with orders from both existing and new partners.

Impressive Growth Rates: Achieved 100% growth in South Africa and the Middle East.

SAARC Market Revival: Key SAARC markets, including Sri Lanka and Bangladesh, saw a revival, with growth noted in Nepal compared to the previous year.

- Challenges in Key Markets:

- Persistent challenges in markets such as Egypt, Sudan, and Myanmar.

- In Vietnam, faced issues due to higher import duties on Indian products compared to those from China.

- European Market Progress: Secured a foothold in European markets, but experienced subdued purchases from UK retailers due to a weak summer in 2023.

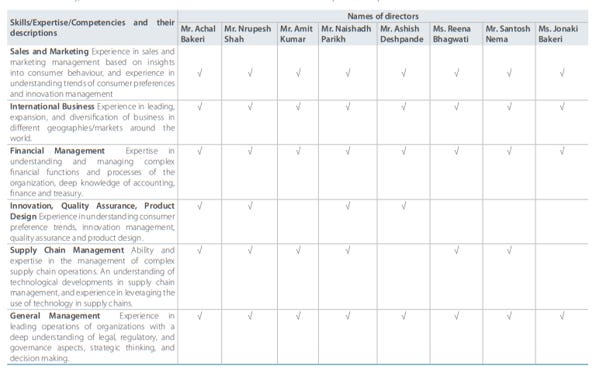

5. Management Overview:

Name: Achal Bakeri

Designation: Chairman, Managing Director and Founder.

Qualification: Architect and MBA (University of Southern California).

DIN: 00397573

Name: Nrupesh Shah

Designation: Managing Director - Corporate affairs.

Qualification: B.Com., FCA and CS.

DIN: 00397701

Name: Amit Kumar

Designation: Executive Director & Group CEO.

Qualification: B. Tech. in Mechanical Engineering from IIT Kanpur and MBA (PGDM) from IIMA.

DIN: 01946117

Name: Jonaki Bakeri

Designation: Non-Executive Director

Qualification: Bachelor of Arts.

DIN: 06950998

Name: Girish Thakkar

Designation: Chief Financial Officer.

Name: Mayur Barvadiya

Designation: Company Secretary and Head - Legal.

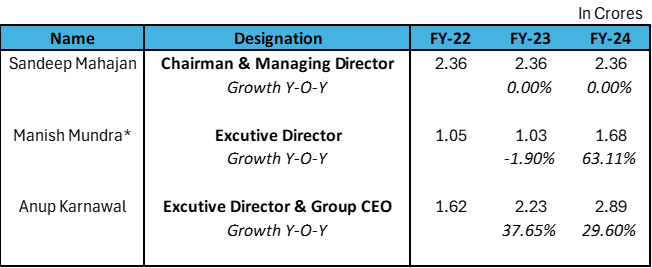

6. KMP’s Remuneration:

7. ESOPs:

The Company did not devise any Right Issue, Preferential Issue, issue shares with differential voting rights, issue any Sweat Equity Shares, or provide any Stock Option Scheme to the employees or Key Managerial Person during the Financial Year 2023-24.

Also, it does not have a recent history of issuing stock options.

If you like the hard work we put in, you can invest in us:

For our Non-Indian audience: You can donate to us through PayPal. Click here.

For our Indian audience, UPI QRs are given below:

8. Key Products/ Services:

Air Coolers:

Residential Air Coolers: Symphony is well-known for its extensive range of home air coolers, available in various sizes and models. These include:

Personal Air Coolers: Compact units designed for single rooms or small spaces.

Desert Air Coolers: Larger units with high airflow, suitable for hot and dry climates.

Tower Coolers: Slim and tall, ideal for limited space areas, providing powerful airflow.

Window Air Coolers: Designed to fit in windows, these units are efficient for smaller spaces.

Commercial Air Coolers: Symphony has a separate lineup of heavy-duty air coolers designed for industrial and commercial use. These are suitable for factories, large offices, warehouses, and other larger spaces. They include:

Industrial Air Coolers: High-capacity units specifically built for cooling large industrial spaces.

Central Air Coolers: Integrated cooling systems that can provide cooling across large areas.

Water Heaters:

The company was in the business of water heaters earlier as well but it was because of the financial stress that, in the early 2000s and in the 2000s they had to exit from the category so as to conserve resources and focus on air coolers

The water heaters come in 3 ranges:

Symphony SPA: Flagship model which is 5-star range and will come in 3 different sizes.

Symphony SOUL: conventional shape cylindrical form with a plastic body. And this will also come in 3 sizes.

Symphony SAUNA: a traditional cylindrical shape and metal body and comes in 3 sizes.

Global Brands: Master Cool, Arctic Circle, KI, BONAIRE, CELAIR, AIRAZONA, Travel Aire, DADANCO

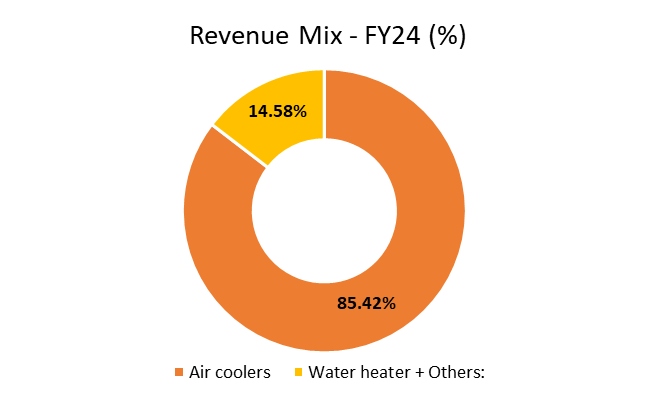

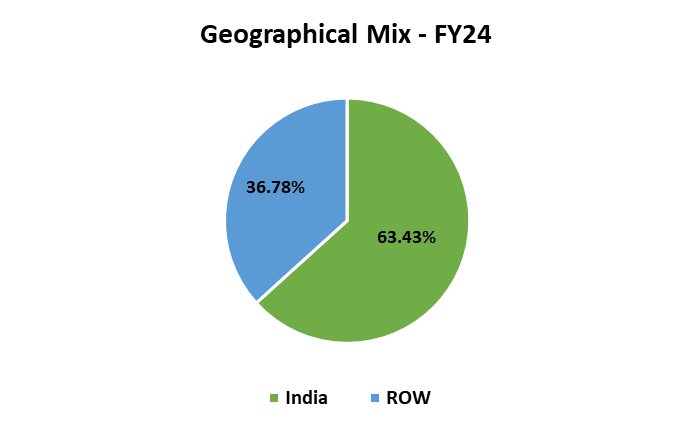

9. Revenue/ Turnover Analysis:

Revenue/Turnover- Geographies (FY-24)

Source- Annual Report

10. Company’s Financial Analysis:

SALES

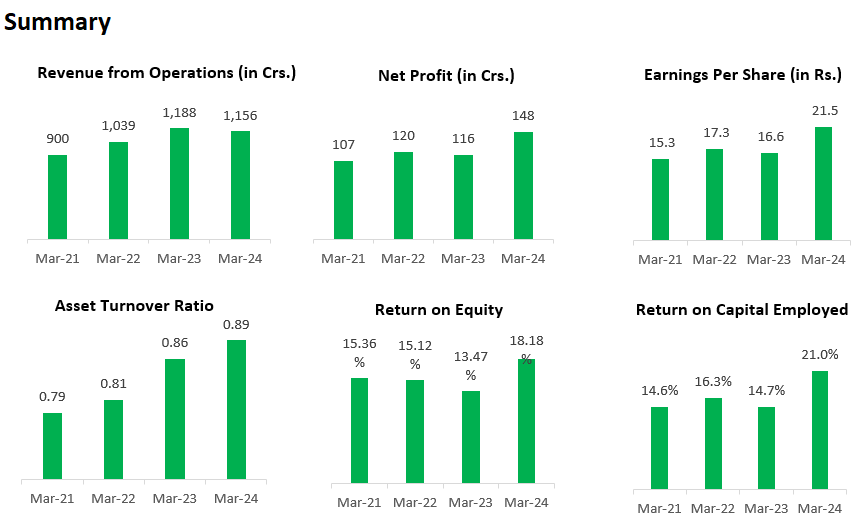

The Sales have grown at a CAGR of ~9% in the past 10 years.

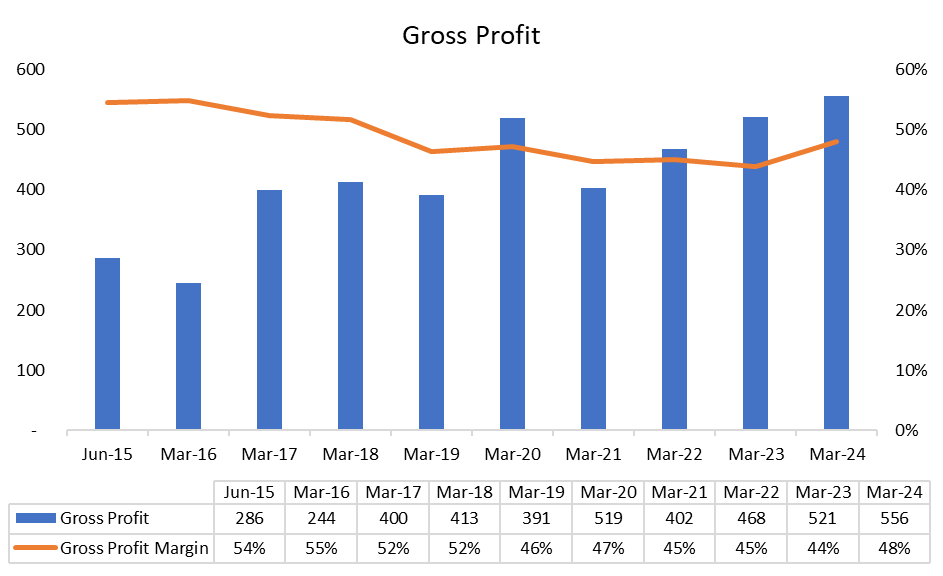

Gross Profit Margin %

Gross profit saw a dip during FY21 due to COVID-19’s impact and rising interest rates. As these are EMI-based goods in India, the sale is highly affected by higher rates. The company has recovered since then.

The gross margins have come down from the mid-50s to the mid-40s. In FY24, we saw a recovery from 44% in FY23 to 48% in FY24 due to the drop in Material cost in FY24 as well.

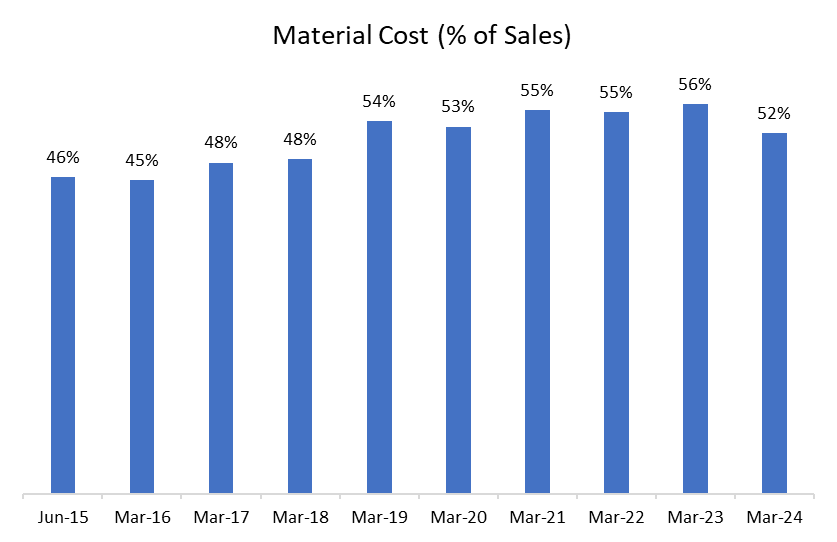

The raw material cost has increased from ~46% in FY15 to ~56% in FY23. A recovery has been experienced in FY24 with cost being 52%. No specific reason was found.

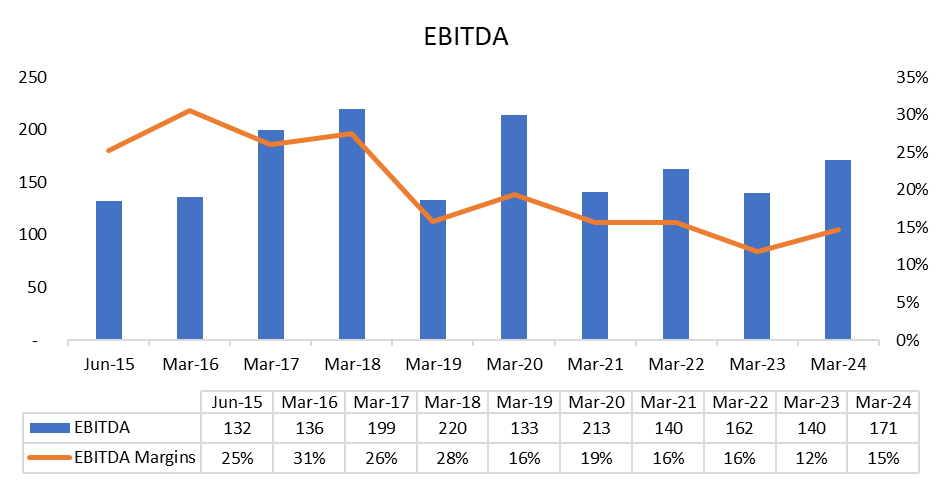

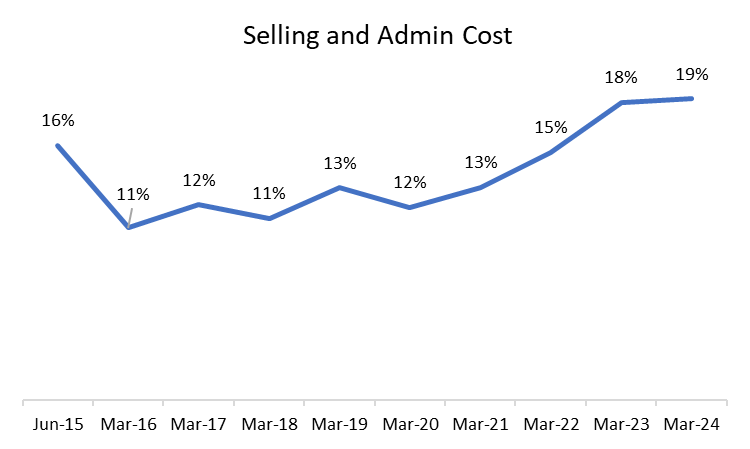

EBITDA Margin %

EBITDA Margin has seen a fall due to the drop in Gross Margins and an increase in the Selling and Admin expenses. We have seen a recovery in FY24.

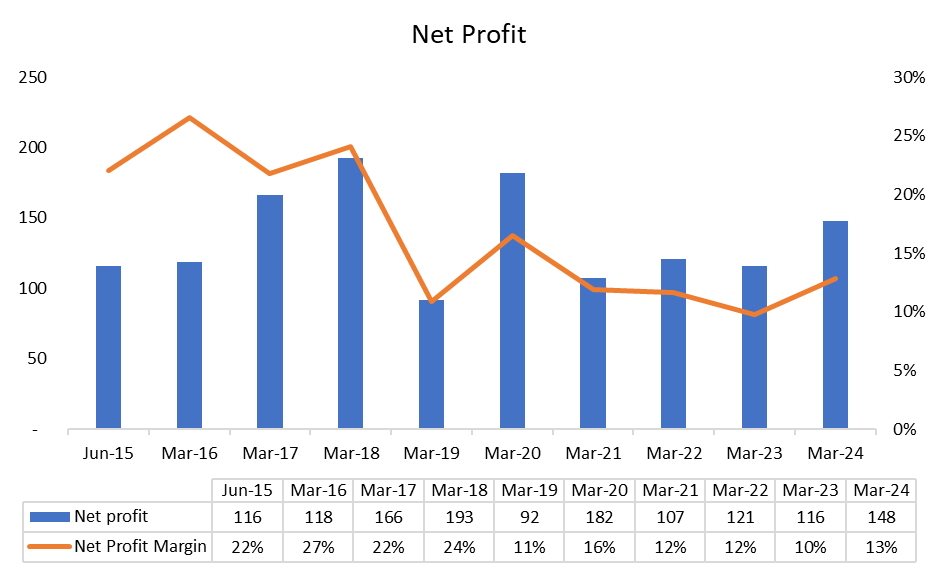

Net Profit Margin %

The company is struggling to maintain its Net profit levels. In fact, net profit in FY15 and FY23 was Rs. 116cr. This is majorly due to fall in margins. On the other hand, we are witnessing a recovery in Net profit amount since FY21. In FY24 the amount saw a spike to Rs. 148cr.

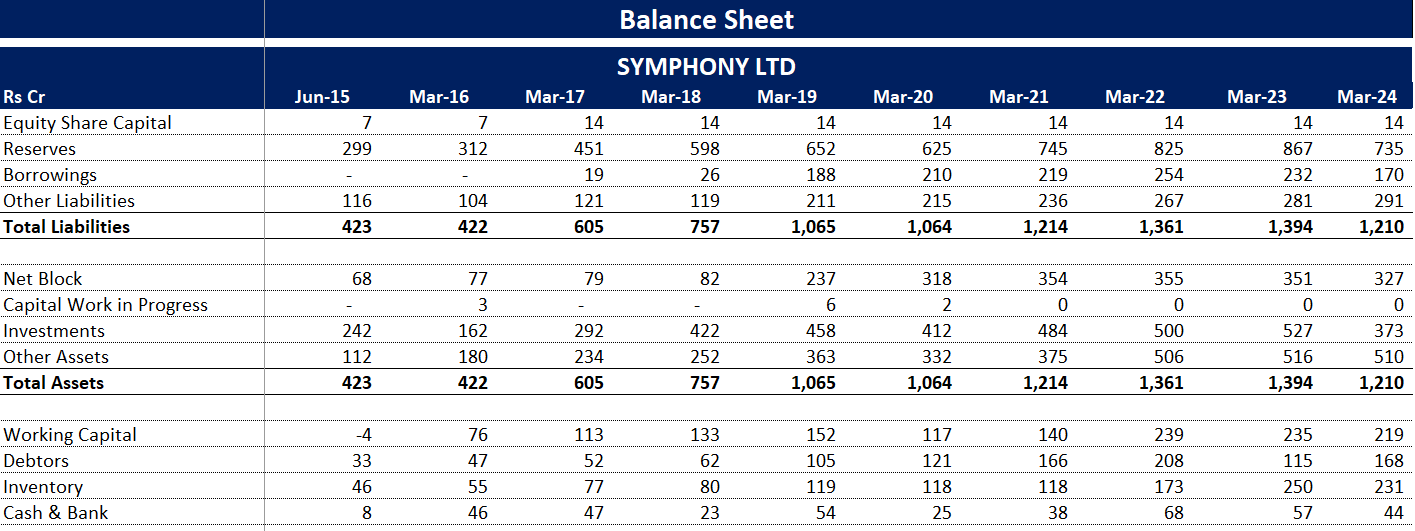

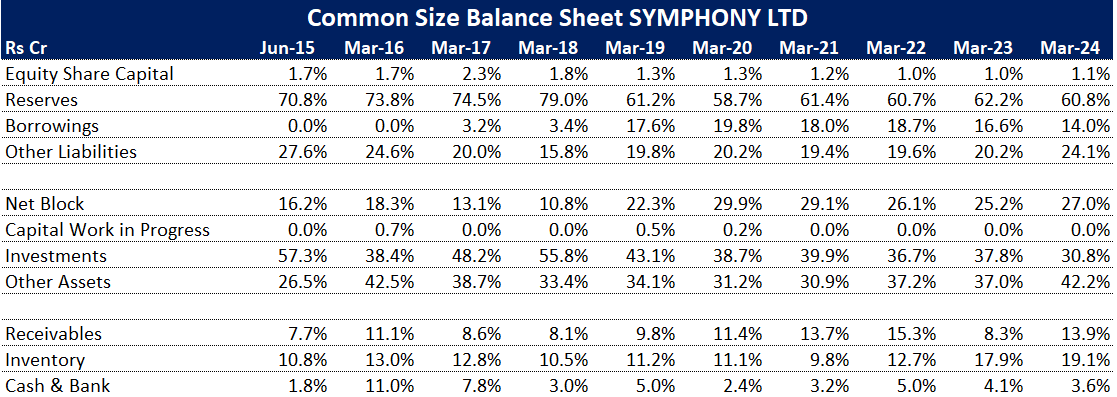

BALANCE SHEET:

If we look at the common size balance sheet, we can notice that the borrowings have come down significantly. Further:

Long-term borrowings have come down from Rs 124cr in FY19 to Rs 44cr in FY24.

Short-term borrowings remain constant at ~rs. 100 cr level.

Other liabilities majorly include Trade payables which have gone from Rs. 50 cr in FY16 to Rs. 149 cr in FY24.

The inventory levels have increased. The management has decided to keep high inventory for future expectation of higher demand.

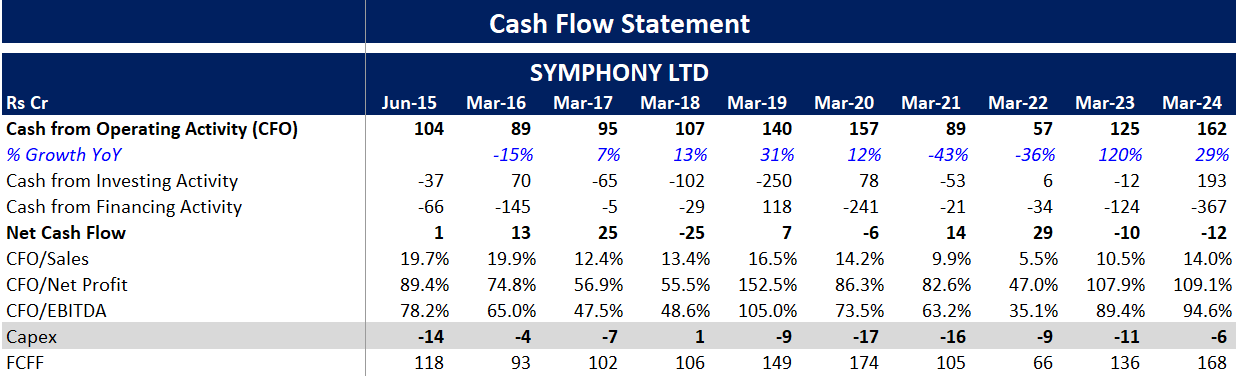

Cashflow Statement:

The major drop in the CFO in FY21 and FY22 is due to a dramatic increase in Receivables and Inventory.

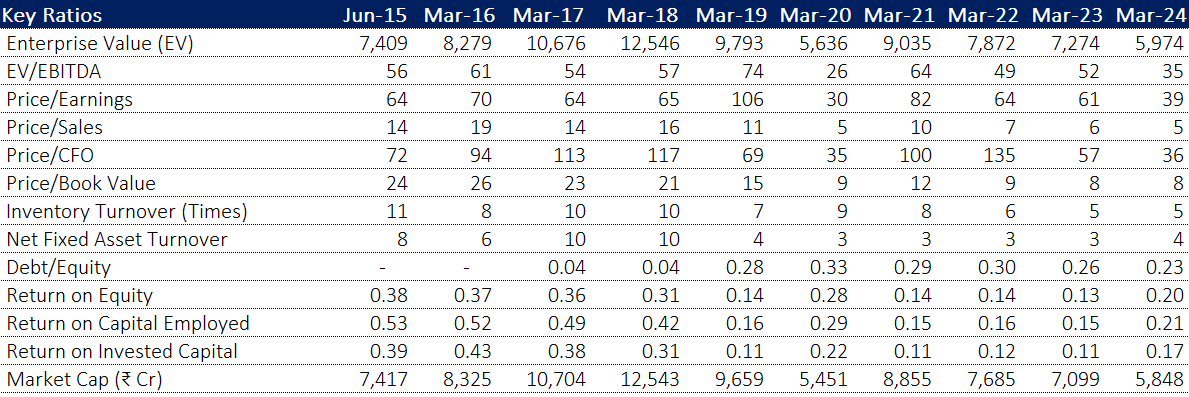

KEY Ratios:

P/E has come down.

ROE, ROIC & ROCE fell but have recovered in the past year.

Debt to Equity has come down from 0.33 in FY20 to 0.23 in FY24.

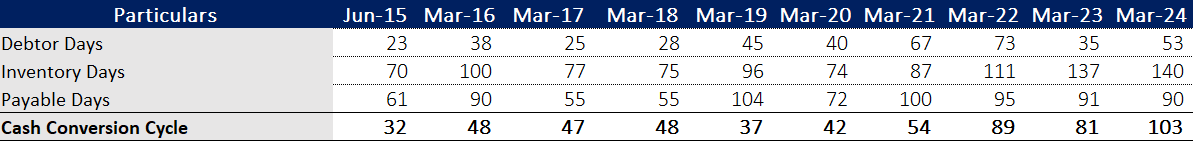

Cash Conversion Cycle:

Debtor days increased due to higher business from regions where credit line is higher. It is expected to come down as Receivables have come down from Rs. 168 cr on Mar 24 to Rs. 96 cr on Sep 2024.

The inventory days have increased significantly due to stocking for future demand.

Payable days have remained stable around higher double digits.

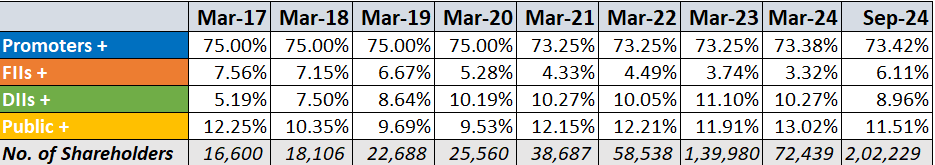

11. Shareholding Pattern:

No significant changes in holdings.

12. MD&A:

Indian Economy:

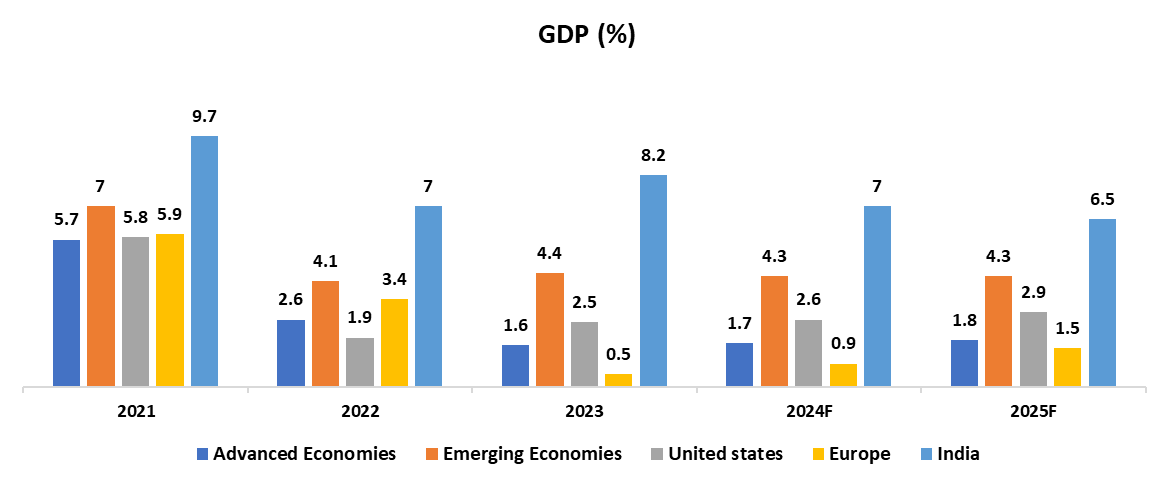

GDP:

Global GDP is projected to grow at 3.2% in 2024 and 3.3% in 2025. The trades have become firm supported by the strong exports from Asia, especially the technology sector. The businesses are majorly on ‘cost-cutting’ projects as the discretionary spendings are still low. Governments are facing fiscal challenges due to higher interest rates, spending on citizen schemes and climate change.

(Source: IMF, World Bank)

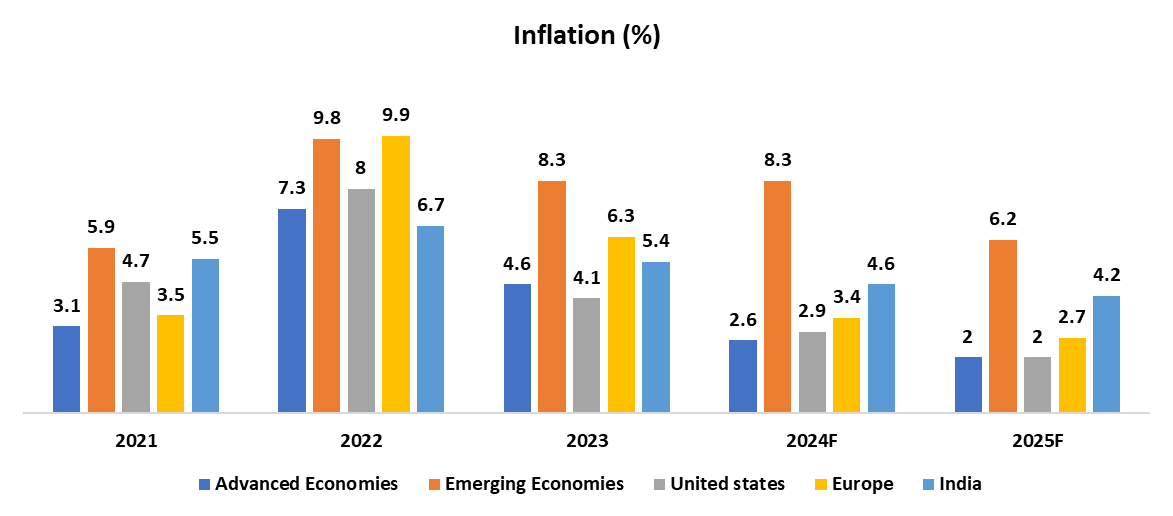

Inflation:

The economy has stayed remarkably resilient and thus, the inflation is coming back to the target level. Even during the high-inflationary environment, the consumption was still on rise especially in the emerging economies. The economy, despite facing deflation and recession warnings, has been growing steadily. Forecasts suggest for inflation to come down from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025 globally.

(Source: IMF, World Bank)

Indian Air-cooler market:

Market Size and Growth:

Indian air coolers market was valued at USD 500 million+ in 2023.

Expected to double over the next 5-7 years due to factors like rising temperatures and improved distribution.

Eco-Friendly and Cost-Effective Solution:

Air coolers are preferred due to lower operational and electricity costs compared to air conditioners.

Use no harmful cooling agents (CFC or HFC), making them environmentally friendly.

Consumer Preferences and Product Types:

Demand is strong in residential and commercial spaces with dry climates and proper ventilation.

Tower and Personal Air Coolers are gaining popularity due to compact size, growing e-commerce, and more brand options.

Market Segmentation and Sales Channels:

Air coolers are part of the fastest-growing consumer durables sector in India.

Growth supported by online sales channels and increasing brand variants.

Widespread Adoption:

In India’s 300+ million households, many rely on fans and air coolers during summer.

Known for energy efficiency, optimal humidity, and high air quality.

Environmental and Economic Benefits:

Air coolers offer a 90% reduction in electricity consumption compared to air conditioners, positioning them as a cost-effective cooling alternative.

Growth Drivers for the company:

Climate and Rising Temperatures: Prolonged summer seasons with high temperatures, often reaching 45°C, drive the demand for affordable cooling solutions. Air coolers are cost-effective, meeting the cooling needs of both urban and rural areas.

Increasing Electricity Access in Rural Areas: Expanded rural electrification has increased electricity availability, allowing more households in remote areas to adopt cooling appliances. Air coolers provide an economical alternative to air conditioners in these newly electrified regions.

Growing Disposable Incomes and Urbanization: Rising incomes and rapid urbanization mean more households can afford air coolers. The development of new residential and commercial spaces also boosts demand for accessible, affordable cooling solutions in cities and emerging towns.

Eco-Friendly and Energy-Efficient Preference: Consumers are increasingly aware of environmental impacts and energy costs, favoring air coolers for their low energy consumption and lack of harmful refrigerants. This aligns with a shift toward sustainable, energy-efficient products.

Expansion of E-Commerce, Distribution Networks, and Industrial Demand: The growth of e-commerce and improved distribution networks have increased accessibility to air coolers, especially in semi-urban and rural areas. Additionally, there is a rising demand for air coolers in industrial and commercial spaces—such as factories, warehouses, and large retail outlets—where affordable and efficient cooling is essential for operations and worker comfort.

13. Q2 FY25 Concall Analysis:

Financial Highlights

Revenue Growth: The company reported a year-over-year revenue increase of 12%, reaching INR 1,200 crore, up from INR 1,070 crore in the previous year. This growth was attributed to strong sales across key market segments and favorable market conditions.

Margin Expansion: Operating margins improved to 18%, compared to 16% in the prior quarter, driven by cost-cutting measures, strategic pricing, and supply chain efficiencies.

Net Profit: The company’s net profit rose by 15% to INR 180 crore, from INR 156 crore in the previous period, supported by operational efficiency and reduced expenses.

Strategic Updates

Product Innovation: The company allocated 5% of its revenue to R&D this quarter, focusing on the development of eco-friendly and energy-efficient products. Several new products are set to launch, particularly targeting the residential cooling market.

Expansion into Emerging Markets: Expansion plans include a strategic push into Southeast Asia and parts of Africa, where urbanization and demand for affordable cooling solutions are rising. The company expects a 20% revenue contribution from these regions within the next three years.

Digital Transformation Initiatives: Investments in digital tools, like an enhanced customer service portal and automated supply chain management, have been initiated to streamline operations and enhance customer experience.

Market Outlook

Industry Demand: Management highlighted a positive demand trend due to urbanization and global warming. The air cooling market is projected to grow at a CAGR of 8% over the next five years, and the company aims to capture a significant portion of this growth.

Competitive Landscape: Although the company faces competition from both local and international brands, it plans to maintain its competitive edge through product quality, pricing strategy, and customer-centric innovations.

Management Commentary

Sustainability and Future Focus: Sustainability remains a priority, with management committing to reduce the carbon footprint of its operations by 15% over the next two years. Plans include a shift towards more recyclable materials in product design.

Risks and Mitigation: Management acknowledged challenges, such as currency fluctuation and increasing raw material costs. Hedging strategies and efforts to source local materials are being explored to manage these risks effectively.

14. SWOT ANALYSIS

Strengths

Market Leader in Air Coolers: Symphony is a dominant player in the air cooling segment, holding significant market share in India and growing its presence internationally.

Strong Brand Recognition: Known for its quality and innovation, Symphony enjoys strong brand loyalty and recognition, especially in warmer regions.

Energy-Efficient Products: Symphony’s emphasis on eco-friendly, energy-saving air coolers is appealing to environmentally conscious consumers and reduces utility costs.

Diverse Product Portfolio: The company offers a wide range of products for residential and commercial purposes, catering to various customer segments and cooling needs.

Weaknesses

Limited Product Range: Symphony mainly focuses on air coolers, which can limit its growth compared to competitors offering a wider range of home appliances.

Seasonal Demand: Symphony’s products are highly seasonal, with demand peaking in summer months. This dependency makes it vulnerable to fluctuations in seasonal weather patterns.

High Competition in Entry-Level Segment: Although a leader in air coolers, Symphony faces intense competition from local and international brands, especially in the lower-priced cooler segment.

Opportunities

Global Expansion: Symphony has potential to expand its market presence in other hot regions globally, such as Africa, Latin America, and parts of Asia, where air cooling solutions are in high demand.

Growing Demand for Energy-Efficient Appliances: As demand for energy-efficient, eco-friendly appliances rises, Symphony is well-positioned to capitalize on this trend through innovative cooling solutions.

Product Diversification: The company could diversify its product portfolio to include additional cooling or climate control solutions, like portable air conditioners or advanced humidifiers.

Urbanization and Rising Disposable Incomes: Rapid urbanization and rising incomes in emerging markets can boost demand for affordable air cooling solutions, particularly in warmer climates.

Threats

Intense Competition from Air Conditioning Brands: Air conditioning brands increasingly offer energy-efficient models at competitive prices, challenging Symphony's position in cooling solutions.

Rising Raw Material Costs: Increases in the cost of raw materials, such as plastics and metals, could impact Symphony’s profit margins.

Economic Slowdowns: Slow economic growth or recessions in key markets could reduce consumer spending on non-essential appliances, impacting sales.

Climate Variability: Unexpected weather patterns, like cooler summers, could decrease demand for air coolers, impacting seasonal sales and revenues.

15. New Initiatives and Opportunities

- Exploring Opportunities in Industrial Applications

Symphony is pursuing growth by targeting the industrial applications market.

The company is focusing on products specifically tailored for data centers.

Symphony’s subsidiary in China is driving the development of a product designed for data center environments. This development is in the early stages.

- Strategic Diversification

- The initiative shows Symphony’s strategic focus on diversifying its product offerings.

- Potential Market Entry in Two Years

Symphony aims to enter the data center market within the next two years, pending successful product commercialization. Actual market entry depends on further development progress and a successful product launch.

Distribution Network Expansion

Increased Market Penetration: Reaching new markets allows Symphony to capture untapped demand, expanding its market share.

Revenue Growth: Widening distribution channels contributes to higher sales and revenue.

Brand Awareness: Extending the distribution network bolsters brand visibility and recall.

Product Diversification

Revenue Diversification: Broader product lines reduce reliance on a single category, stabilizing revenue.

Cross-Selling Opportunities: Expanded offerings enable cross-selling and upselling to existing customers.

Enhanced Customer Value Proposition: A diverse range of products meets varying customer needs and preferences.

Operational Efficiency

Cost Reduction: Focus on value engineering to reduce costs, enhancing profitability.

Brand Campaign Reimagining

Brand Strengthening: The reimagined campaign reinforces Symphony’s brand identity and leadership.

Customer Loyalty: Strong branding builds loyalty, fostering repeat purchases.

Market Differentiation: A distinct brand presence aids in standing out amid the competition.

16. Growth Strategy and Diversification

Symphony’s business growth is not solely dependent on the summer season, although it plays a significant role in the overall sales performance, as air coolers are typically impulse buys during hot weather. To mitigate this seasonality risk, Symphony has invested in several growth initiatives beyond just product expansion. These initiatives include:

Product Innovation and Development: Symphony continuously focuses on developing new products and enhancing existing ones to cater to a broader market.

Distribution Network Expansion: The company has worked on improving the breadth and penetration of its distribution channels to reach a larger consumer base.

Brand Building and Aftersales Service: Symphony emphasizes strong brand-building efforts and provides reliable aftersales service to ensure customer satisfaction and loyalty.

Additionally, Symphony has diversified its product offerings and markets:

- Adjacent Categories: Symphony has entered new segments, such as tabletop models, which are seeing strong sales year-round.

- Geographical Diversification: Symphony is expanding its presence in the Southern Hemisphere, particularly in markets like Brazil and Australia, where the seasons are opposite to those in India, helping balance the seasonal effects. The company also benefits from operations in Mexico and Climate Technologies, which are involved in non-air cooler products, further de-risking the business model.

17. Management Guidance

Positive Outlook for the Next 3-5 Years

Growth is expected both in the Indian market and international subsidiaries.

Double-digit compound annual growth rate (CAGR) projected for India operations, indicating recovery from recent challenges.

Performance of International Subsidiaries

Successful Growth in Three Subsidiaries

Three out of four international subsidiaries are showing steady growth.

Focus on the Australian Subsidiary

Australian operations are not yet profitable.

Management is confident of recovery, similar to other subsidiaries’ turnarounds.

Recovery anticipated over a longer timeline than initially expected, with a "hockey stick" growth trajectory (marked improvement after a low point).

Strategic Adjustments

Optimism surrounding recent strategic changes.

Expectation of stronger financial performance across global operations in the near future.

18. Competitors in the Market:

Bajaj Electricals: Offers affordable, durable coolers popular in households across India, with extensive distribution networks.

Havells India Ltd: Known for stylish, feature-rich models targeting urban consumers, backed by strong customer trust and service support.

Voltas: A Tata enterprise with a reputation for high-capacity, energy-efficient coolers, leveraging its strong AC market presence.

Orient Electric: Offers durable, affordable coolers with sleek designs, widely available across retail and online channels.

(Note : Symphony is the Market Leader in this industry.)

19. Industry Overview:

Introduction:

Air coolers, also known as evaporative coolers or swamp coolers, are devices designed to cool indoor or outdoor spaces by utilizing the natural process of evaporation. These appliances typically consist of a fan, a water reservoir, and porous pads or filters. They offer benefits such as lower energy consumption, eco-friendliness, and affordability compared to conventional cooling methods. Air coolers come in various sizes and capacities to suit different applications, ranging from small portable units for personal use to larger systems for commercial and industrial settings.

Market Definition:

Indian Air coolers market is valued at USD 144.6 million in 2023, and is predicted to reach USD 333.8 million by 2030, with a CAGR of 12.1% from 2024 to 2030.

Source - NMSC

Market Trends:

Increasing Demand for Eco-Friendly Coolers: Companies are introducing products with water-saving and energy-efficient features.

Rising Popularity in Rural Areas: Due to lower power consumption and affordability, coolers are popular in rural areas compared to air conditioners.

Focus on Online Sales: Brands are leveraging e-commerce platforms to reach a broader audience, especially during peak summer months.

As the fifth-largest economy globally, India boasts a formidable nominal GDP of USD 3.73 trillion in 2023, expanding at a robust rate of 7.3% annually. This economic prosperity translates into increased consumer spending power, driving the demand for indoor comfort solutions such as air coolers.

Source - NMSC

Market Segmentation:

The India air cooler market is segmented by end-user, region, and competitive landscape.

End-User Segmentation:

Residential Air Coolers:

Divided by product type: desert, personal, tower, and window air coolers.

Divided by distribution channel: multi-branded stores, exclusive stores, supermarkets and hypermarkets, online, and others (direct sales, institutional sales, etc.).

Industrial & Commercial Air Coolers:

Divided by product type: commercial and centralized air coolers.

Divided by distribution channel: distributors/suppliers/dealers and direct sales.

20. Challenges:

Air coolers face significant challenges in humid and coastal areas, impacting their market growth and adoption.

High humidity in these regions, such as coastal areas or tropical climates, limits the cooling effectiveness of air coolers.

Air coolers rely on water evaporation to lower air temperature.

In humid conditions, where the air is already moisture-laden, evaporation becomes less efficient.

This results in reduced cooling capacity and limited effectiveness of air coolers in such environments.

Technological Advancements to create Future Market Prospects:

Technological advancements present a major growth opportunity for the air cooler market.

Continuous innovation has led to more efficient, feature-rich air cooler models.

Improvements include advancements in fan design, evaporative cooling technology, and intelligent features like remote control and programmable settings.

New features enhance the user experience by addressing key consumer needs such as:

Energy efficiency

Portability and space-saving design

Quiet operation

Improved air quality

These advancements not only boost performance and functionality but also help air coolers stand out in a competitive market.

Integration of smart technologies allows connectivity with other smart home devices, appealing to tech-savvy consumers and increasing adoption.

Thank you for reading till the end! We hope you enjoyed this report.

Researched By- Naresh, Mayank and Vaibhav

All information is sourced from company annual reports, Screener.in, industry reports and Economy Outlook reports.

Disclaimer- We do not recommend buying or selling any stock. You should consult your financial advisor before buying or selling any financial instrument.