Welcome to the 9th edition of our small-cap coverage. Today, we're diving into a well-known Tyre company, “Goodyear India Ltd.”. Let's start! But before we do, here is the link to the 8th edition.

We post a new edition every 2nd Saturday. So Subscribe and stay tuned for our upcoming publications on various companies.

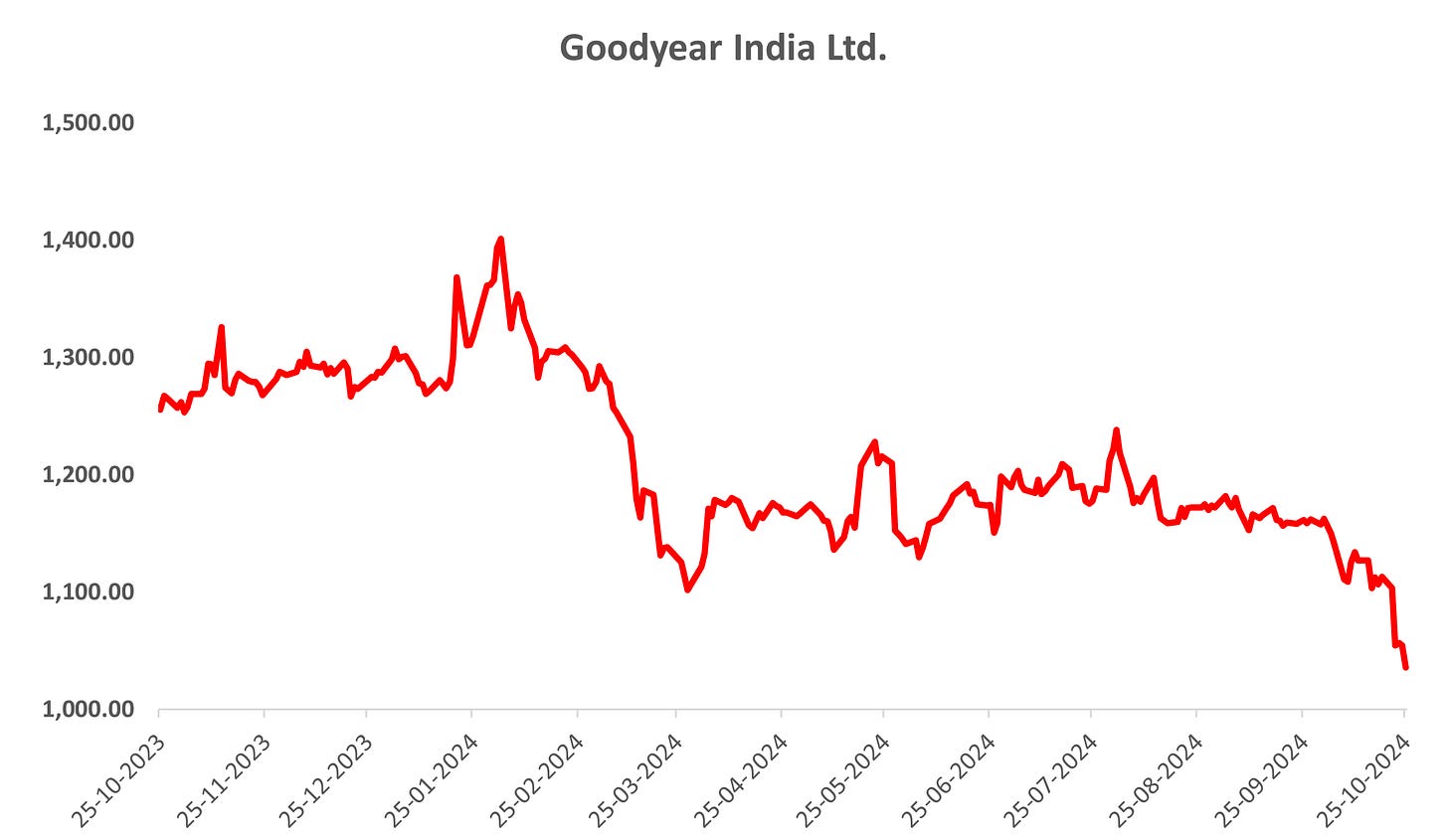

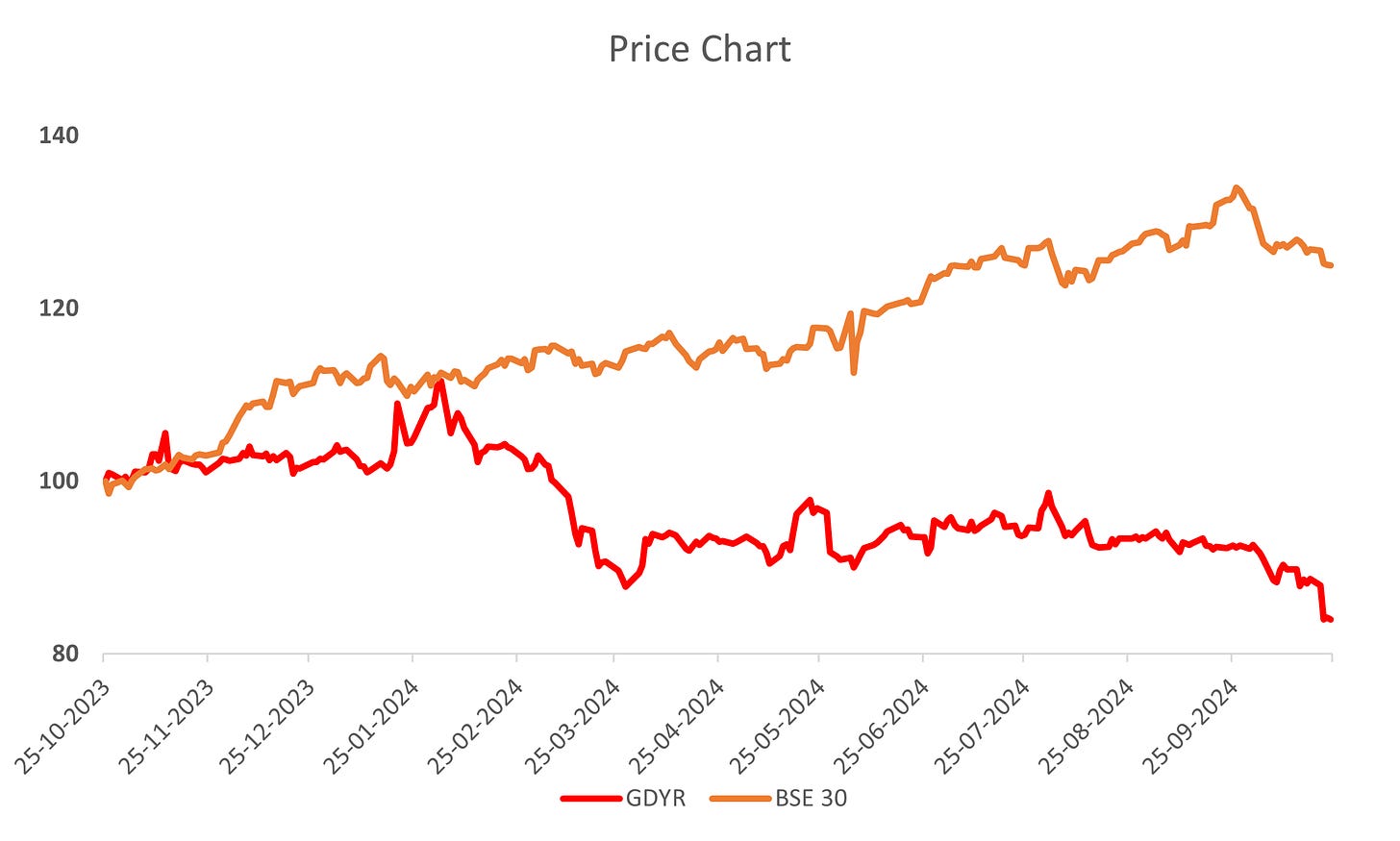

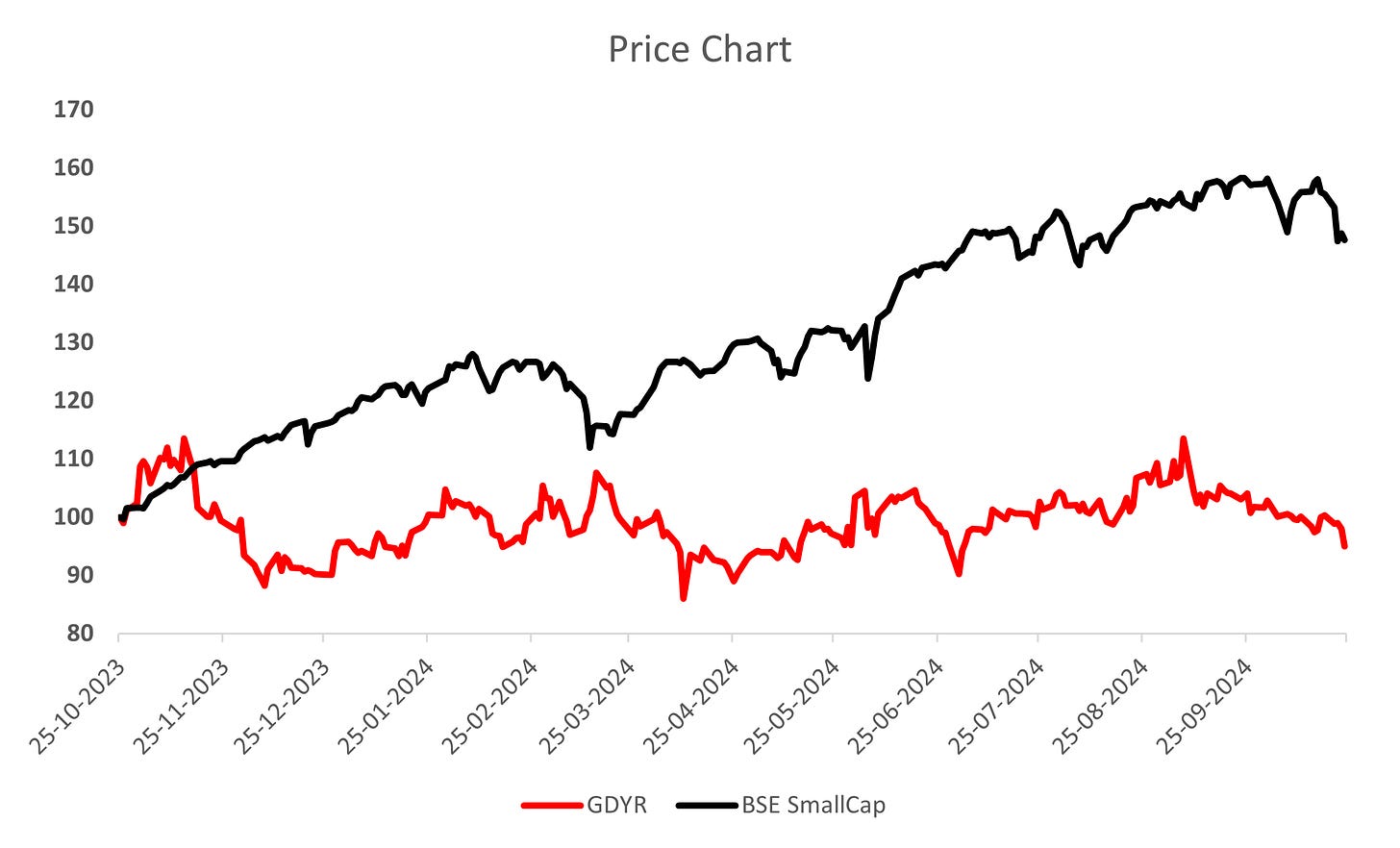

1. Company Share Price chart & comparison with Index:

Comparison with BSE30

Comparison with BSE SMALLCAP

All above charts are *Indexed on 25 Oct 2023 (=100)

2. About company:

Goodyear India is engaged in the business of manufacturing and trading of tyres, tubes, and flaps It is a leading player in the India farm tyre market.

Basic key points:

Registered Name: Goodyear India Limited.

Establishment: 1922.

Products: Manufactures passenger car radial tires for cars and SUVs, and farm tires for agricultural vehicles like tractors.

Industry: Tire manufacturing.

Listed on: Both NSE and BSE.

Website: https://www.goodyear.co.in/

Business Presence

Pan-India Presence: The company has a strong national presence and operates in all states across India.

International Expansion: The company has expanded its operations to 7+ countries, indicating a successful internationalization strategy.

Market Penetration: The widespread domestic presence allows the company to reach a large customer base and capture a significant market share.

Diversification: Operating in multiple countries helps to reduce reliance on any single market and mitigate risks.

Growth Opportunities: International expansion presents opportunities for growth and revenue diversification.

3. Business Model:

Core Operations

Goodyear India is a prominent player in India's tire market, particularly within the farm tire segment. The company focuses on manufacturing and trading a range of automotive tires, including farm tires and commercial truck tires produced at its Ballabgarh facility.

Additionally, Goodyear India supplies the replacement market with passenger car tires manufactured by Goodyear South Asia Tyres Pvt. Ltd. in Aurangabad. Its customer base spans original equipment manufacturers (OEMs) for tractors, passenger car owners, fleet operators, export markets, and ancillary buyers for tubes and flaps.

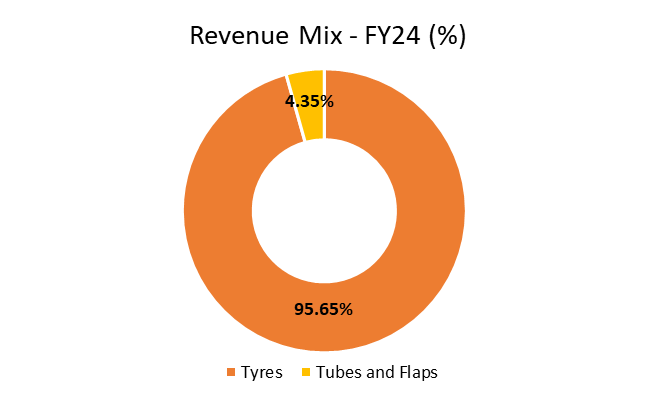

Segments/Products

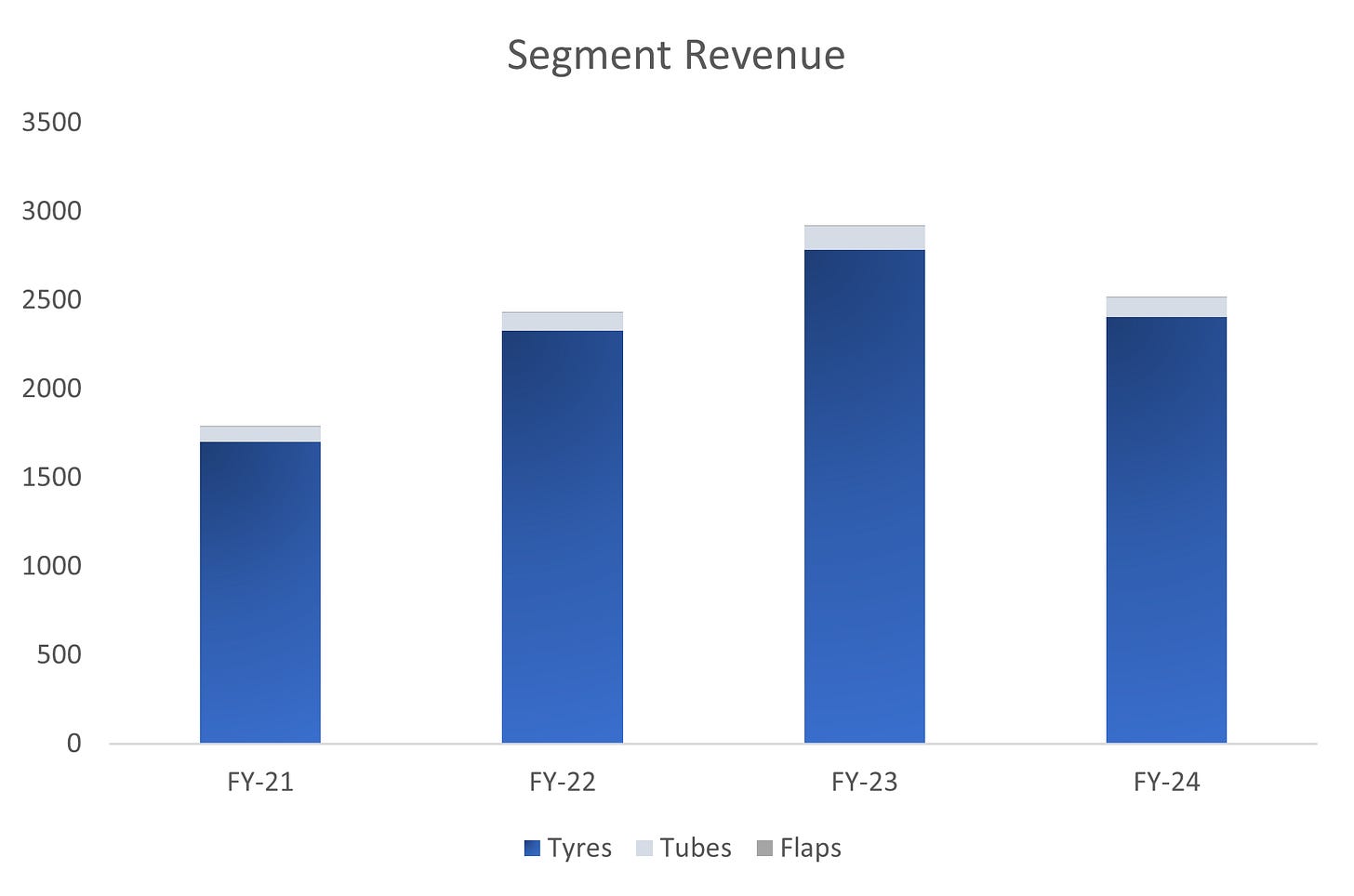

Fig. amount in crores

The company's strong focus on the “Tyres” business is evident in the revenue data.

Tyres Dominate Revenue: The "Tyres" segment consistently accounts for the majority of revenue, representing over 95% of total sales in each fiscal year.

Steady Growth in Tyre Sales: Tyre sales have shown steady growth from FY-21 to FY-23, peaking in FY-23 before experiencing a slight decline in FY-24.

Tubes and Flaps as Complementary Segments: The "Tubes" and "Flaps" segments contribute relatively smaller portions to the overall revenue, but they remain important complementary products.

Diversification with Tubes and Flaps: While tyres dominate revenue, the presence of tubes and flaps provides some diversification and potential growth opportunities.

- Expanding Product Portfolio:

Introducing new products in the luxury SUV and electric vehicle (EV) segments to cater to evolving consumer needs.

Limited presence in the commercial tire segment, impacting portfolio diversification and risk management within the farm category.

- Leadership in Farm Tires:

Leading in the farm tire segment with a focus on superior customer service and account management in the Farm Original Equipment (OE) sector.

In the Farm Replacement sector, they are prioritizing channel expansion, engagement, and operational excellence to ensure timely and cost-effective deliveries.

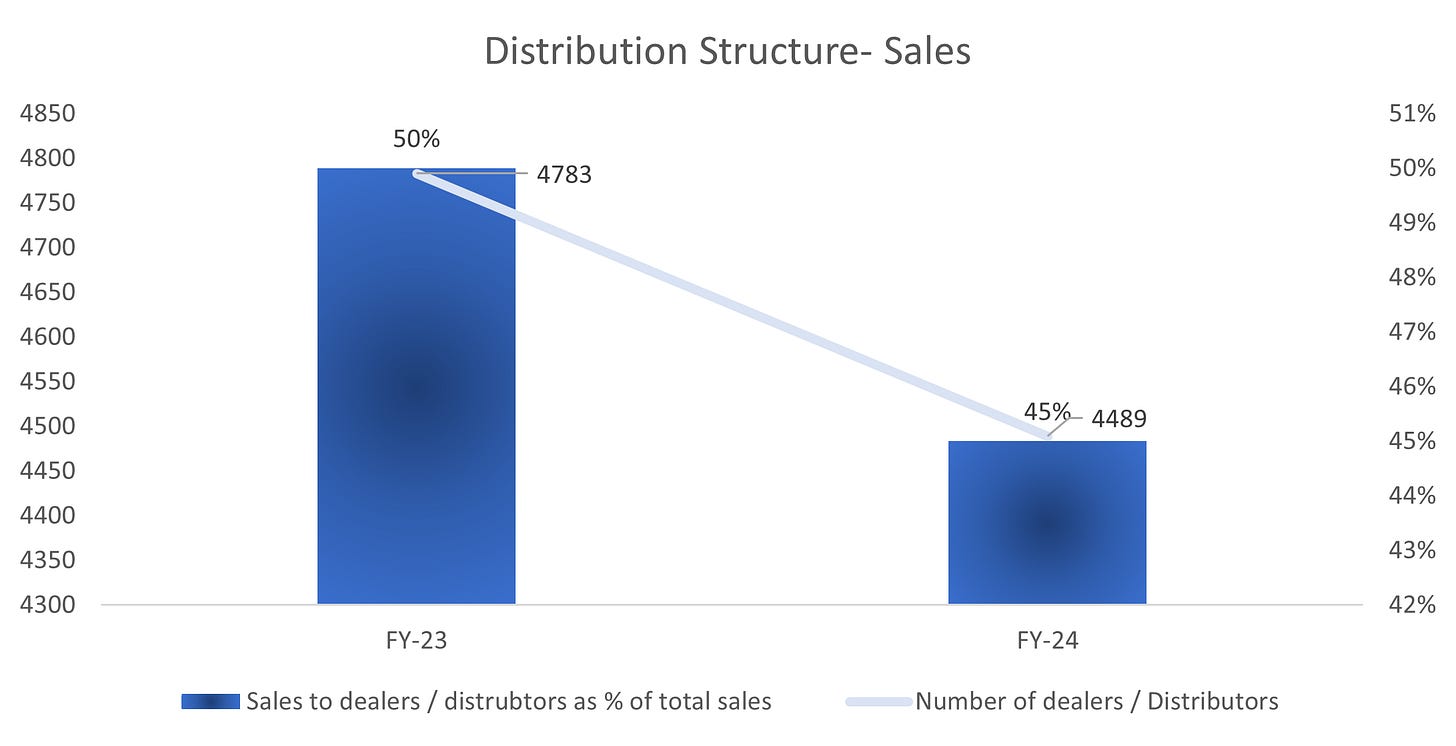

Distribution Structure

Decrease in Sales to Dealers and Distributors: The percentage of sales to dealers and distributors has declined from 50% in FY-23 to 45% in FY-24.

-Competitive Pressure: Increased competition from other players in the market might have impacted the company's sales through dealers and distributors.

-Channel Performance: The decline could also suggest performance issues or inefficiencies within the dealer and distributor network.

Slight Decrease in Number of Dealers and Distributors: The number of dealers and distributors decreased slightly from FY-23 to FY-24, from 4783 to 4489.

Dealer and Distributor Network Reliance: The company's reliance on dealers and distributors for sales remains significant, indicating the importance of this channel in its distribution strategy.

Market Penetration: The extensive network of dealers and distributors allows the company to reach a wide range of customers and penetrate different markets.

Channel Performance: The stability of sales to dealers and distributors suggests that the channel is performing well and effectively reaching customers.

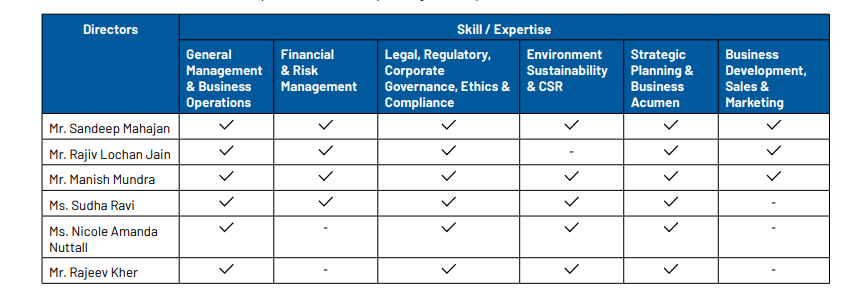

4. Management Overview:

Name: Mr. Sandeep Mahajan.

Designation: Chairman & Managing Director.

Qualification: Bachelor’s in Engineering (Mechanical) and Post Graduate Diploma in Management from Indian Institute of Management, Bangalore.

Age: 59 years.

Nationality: Indian

Name: Mr. Nitesh Kumar Jain.

Designation: Non-executive Director.

Qualification: PhD, Mechanical Engineering and Applied Mechanics.

Age: 45 years.

Nationality: US citizen

Name: Mr. Anup karnwal.

Designation: Company Secretary & Compliance Officer.

Name: Mr. Manish Mundra.

Designation: Whole time director & chief financial officer.

Note: Mr. Manish Mundra has resigned from his office with effect from the close of business hours of June 30, 2024.

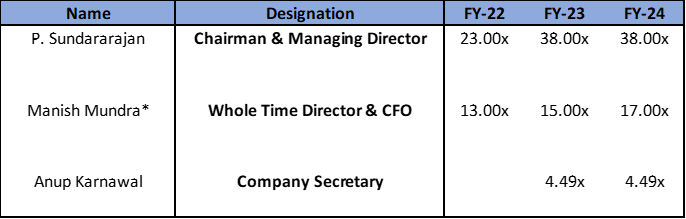

5. KMP’s Remuneration:

KMP Remuneration to Median Employee Remuneration

* Mr. Manish Mundra, Whole Time Director and Chief Financial Officer of the Company resigned from his office on June 30, 2024.

6. ESOPs:

The Company did not devise any Right Issue, Preferential Issue, issue shares with differential voting rights, issue any Sweat Equity Shares, or provide any Stock Option Scheme to the employees during the Financial Year 2023-24.

7. Key Products/ Services:

The company produces and sells automotive tyres, including farm and commercial truck tyres, and markets and sells passenger car tyres. Additionally, it distributes tubes and flaps.

Variety offered:

Assurance – Focused on passenger car tyres, offering comfort, durability, and reliability.

Eagle – Designed for high-performance vehicles, providing superior handling and traction.

Duraplus – Known for longer mileage and durability, mainly targeting everyday driving conditions.

Wrangler – Specialized in off-road and SUV tyres, offering toughness and performance on rough terrains.

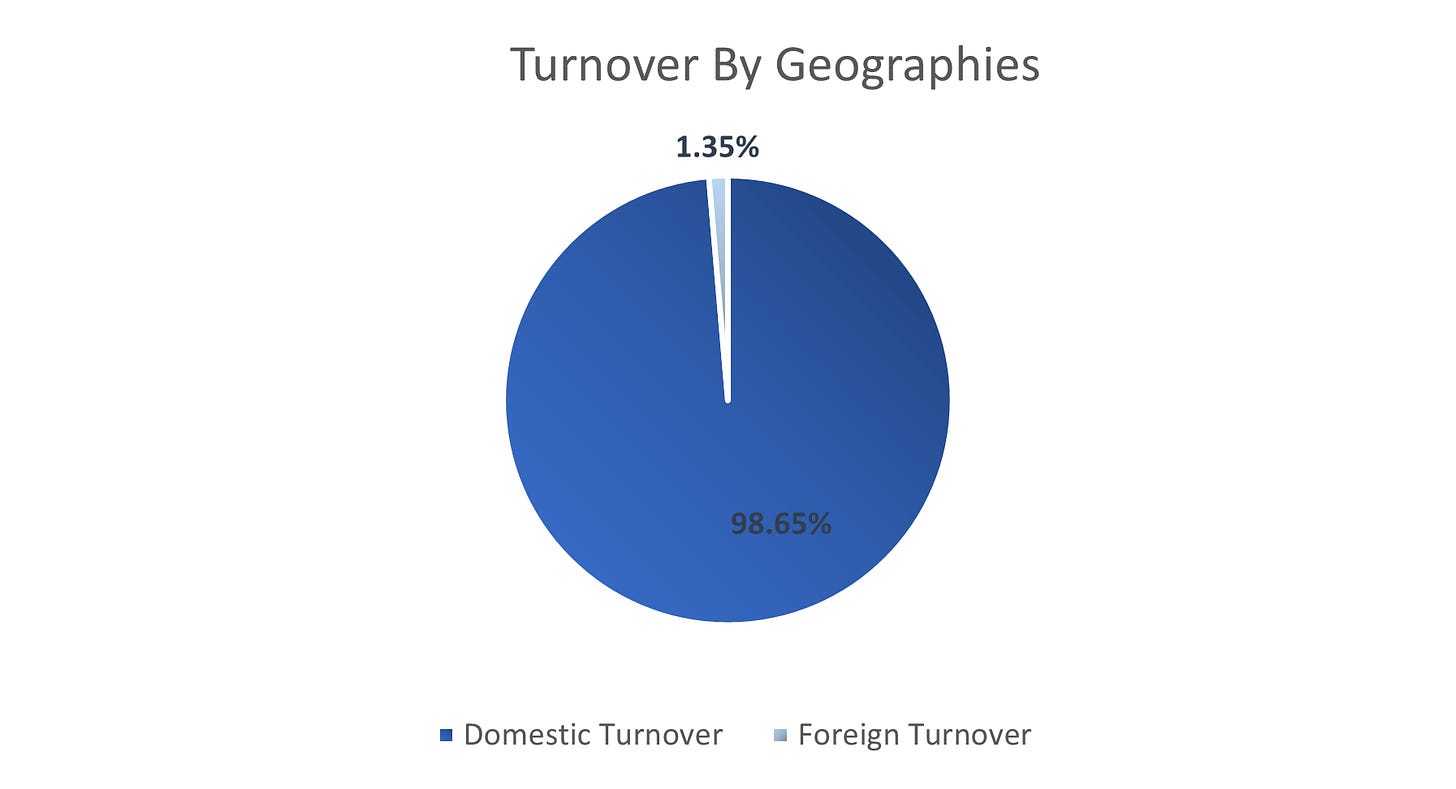

8. Revenue/ Turnover Analysis:

Revenue/Turnover- Geographies (FY-24)

Geographic Revenue Distribution Analysis

Domestic Revenue Focus: 98.65% of total revenue is generated within India, underscoring a strong domestic market focus. The company is primarily structured around serving domestic customers and aligning operations to local needs.

Limited International Reach: Only 1.35% of revenue comes from foreign markets, highlighting minimal international presence.

Growth Potential Abroad: Expanding internationally could provide significant growth and diversification benefits.

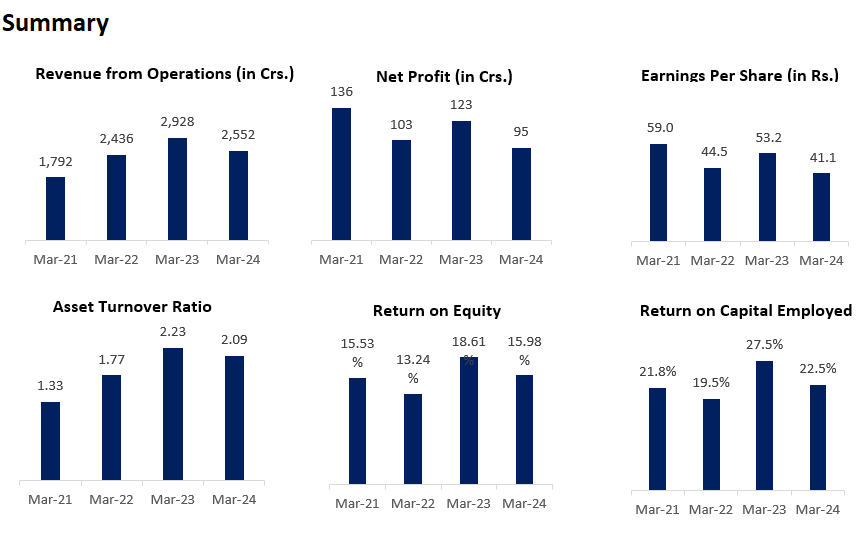

9. Company’s Financial Analysis:

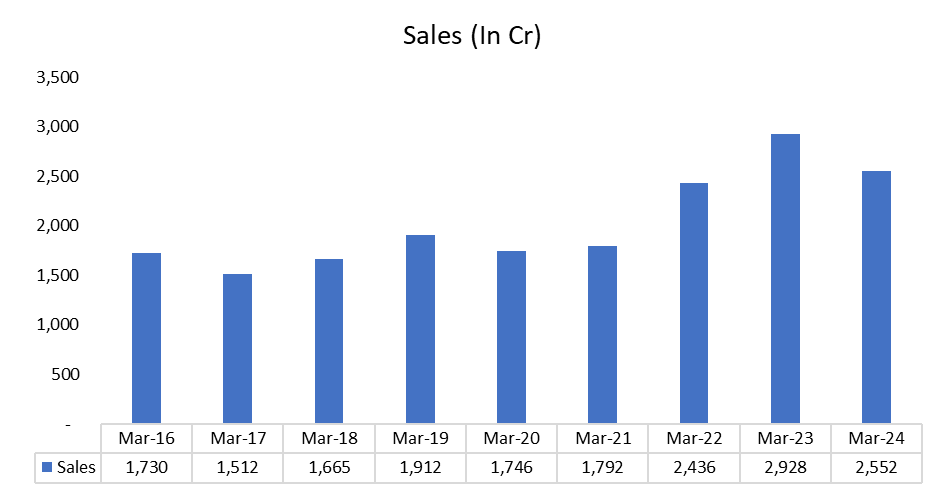

SALES

The Sales have grown at a CAGR of ~5% in the past 9 years.

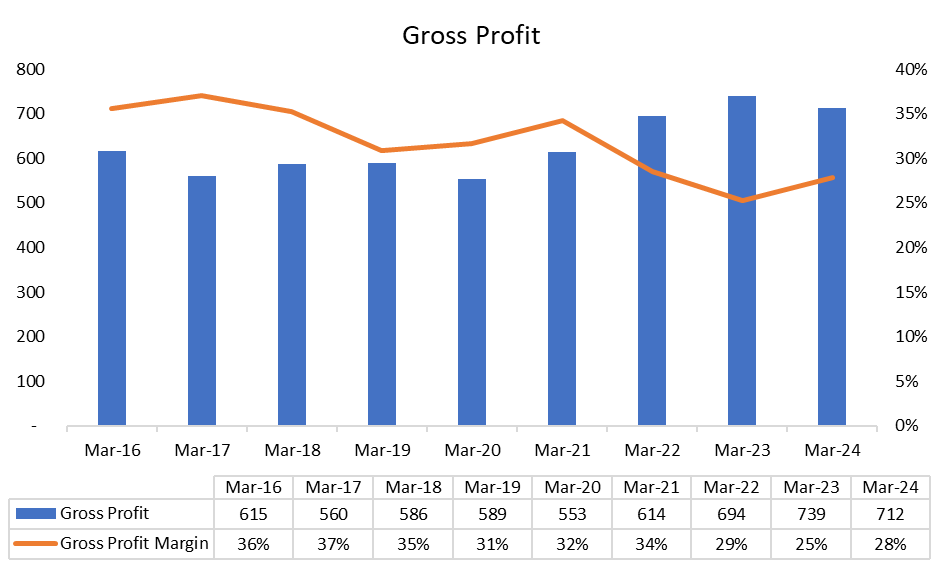

Gross Profit Margin %

The gross margins have fluctuated for the past 10 years mainly due to changes in Material costs. The margin saw a dip in FY22 reaching 29% and have continued to stay below.

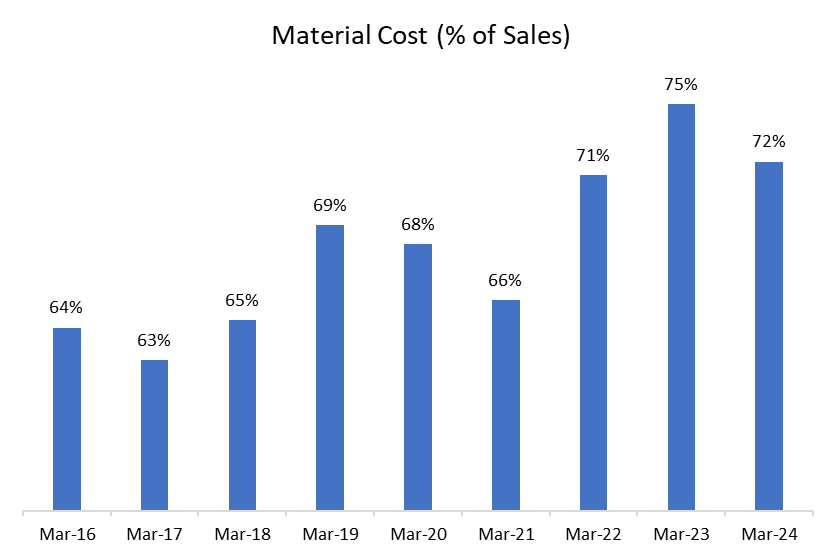

The raw material cost has increased from mid ~64% in FY16 to ~72% in FY24.

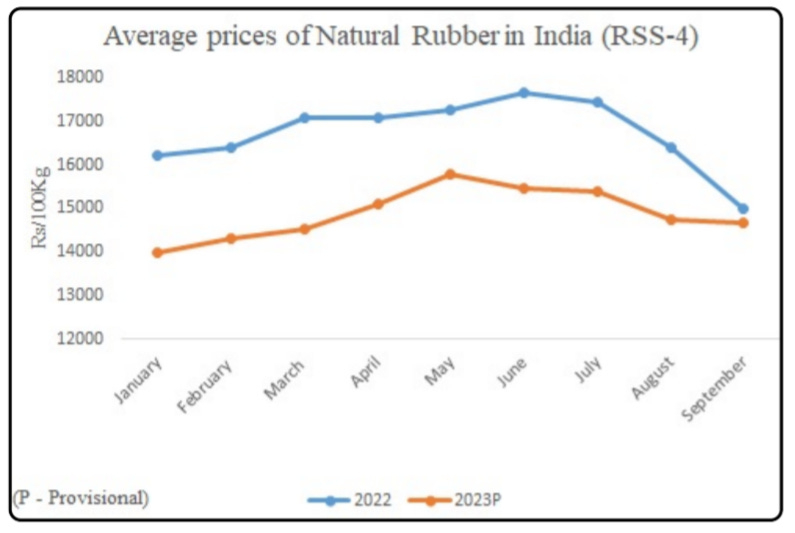

Crisil Report on Raw Material:

Natural rubber is a major input, accounting for 20-40% of the weight of tyres, depending on the category. Indeed, the tyre industry accounts for around 80% of natural rubber consumption in the country.

Says Mohit Adnani, Associate Director- Research, Market Intelligence and Analytics:

“With further rise in demand and restricted supply, the prices of natural rubber are expected to remain elevated, impacting the margins of tyre manufacturers well beyond fiscal 2025. The deficit in the natural rubber market is expected to triple in 2024 as smaller tappable area and lower yield, along with a potential increase in demand, test the supply side.”

Cost Structure:

Rising Raw Material Costs: Raw material costs have varied, rising from 35.65% of revenue in FY-21 to a peak of 43.29% in FY-22, and slightly decreasing to 38.34% in FY-24.

Profitability Concerns: The upward trend poses challenges to profitability, as increased costs squeeze margins.

Profit Impact: Variations in raw material costs directly influence profitability.

Pricing Strategy: Adjusting product prices may be necessary to counterbalance rising costs.

External Factors Affecting Raw Material Costs:

Global Price Fluctuations: Commodity price changes and currency fluctuations impact raw material costs.

Supply Chain Volatility: Disruptions, driven by geopolitical and economic factors, can lead to shortages and price hikes.

Regulatory Impact: Initiatives like the Extended Producer Responsibility (EPR) for waste tyres introduce additional cost considerations.

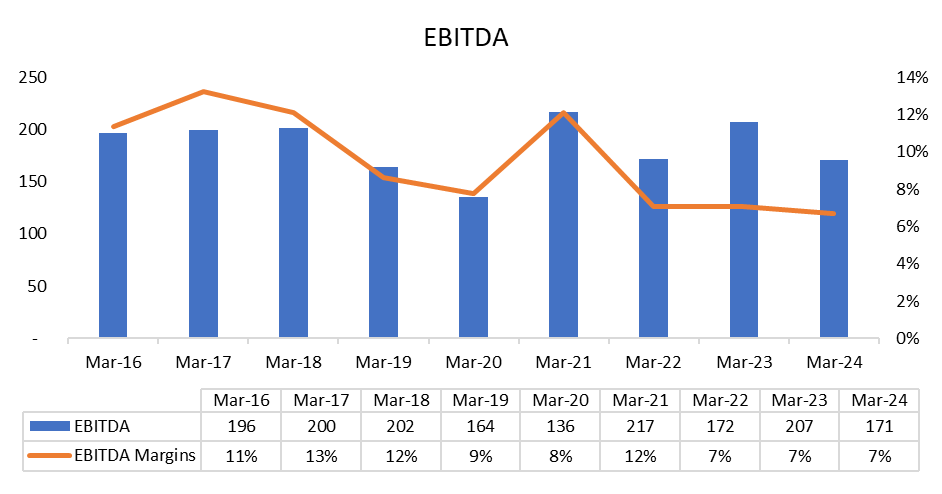

EBITDA Margin %

EBITDA Margin has seen a fall due to the drop in Gross Margins.

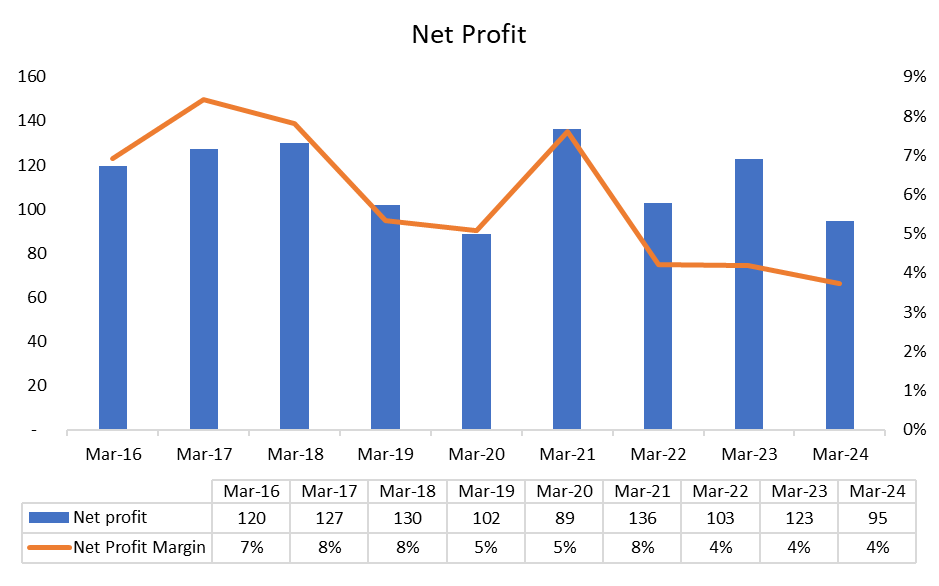

Net Profit Margin %

The company is struggling to maintain its Net profit levels. In fact, it has dropped to double digits in FY24. The margins have fallen due to the drop in Gross margins.

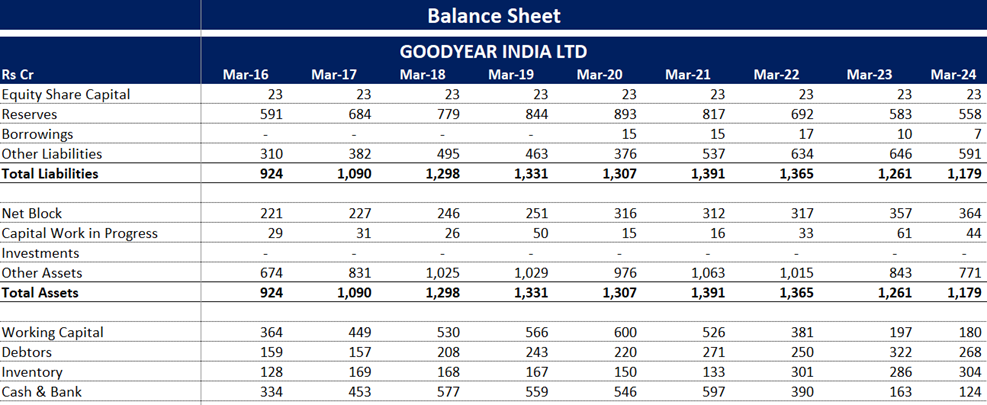

BALANCE SHEET:

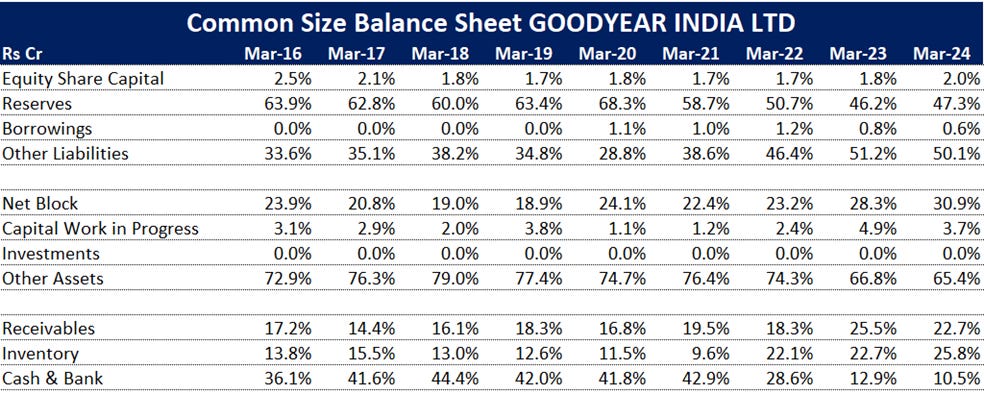

If we look at the common size balance sheet, we can notice that the borrowings have come down significantly. Further:

The company has only Lease liabilities in its borrowings which also have come down in FY24.

Other liabilities mostly include trade payables.

Receivables (as % of Total Assets) have increased by 5.5% and Inventory (as % of Total Assets) has become almost double going from 13.8% in FY16 to 25.8% in FY24.

Cash (as % of Total Assets) has come down significantly.

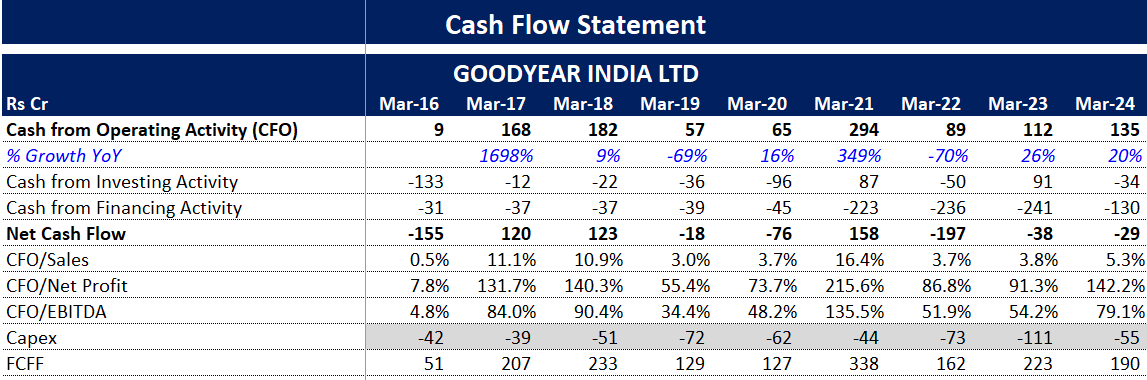

Cashflow Statement:

The major drop in the CFO in FY22 is due to a significant rise in Inventory.

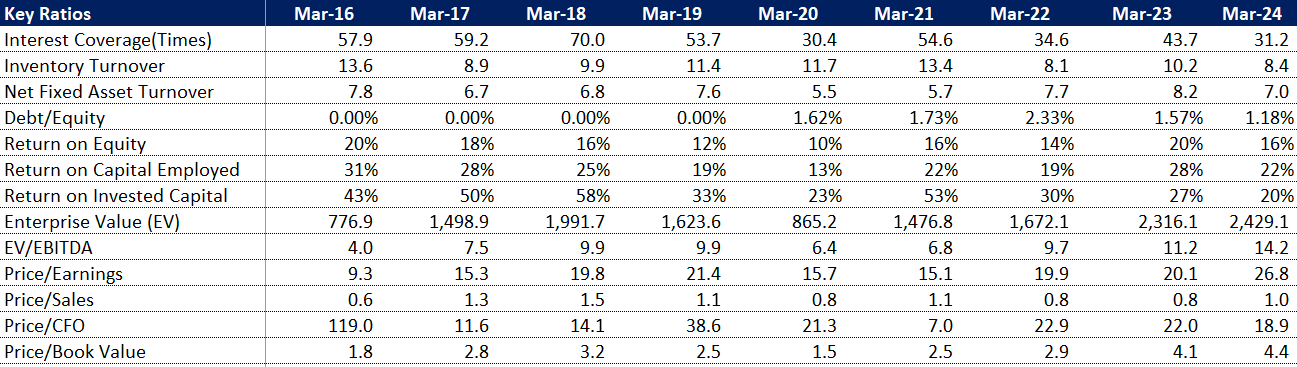

KEY Ratios:

Interest Coverage has deteriorated.

ROE & ROCE fell but have recovered in the past 2 years.

ROIC has fallen significantly in the past 3 years.

EV/EBITDA has risen in the past 2 years which is not a good sign.

The P/E has gone 3 times in the past 9 years.

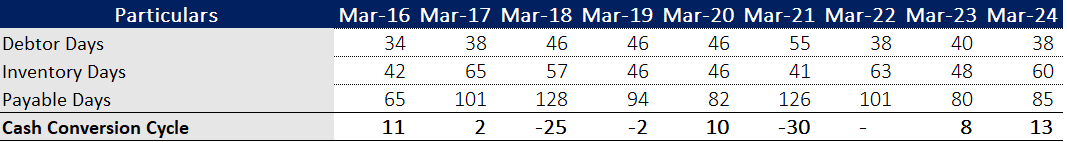

Cash Conversion Cycle:

Debtor days have remained stable.

The inventory days have increased.

Payable days have increased significantly with the peak of 126 days in FY21.

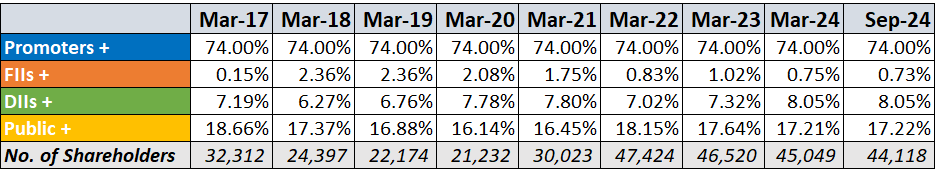

10. Shareholding Pattern:

No significant changes in holdings.

11. MD&A:

Indian Economy:

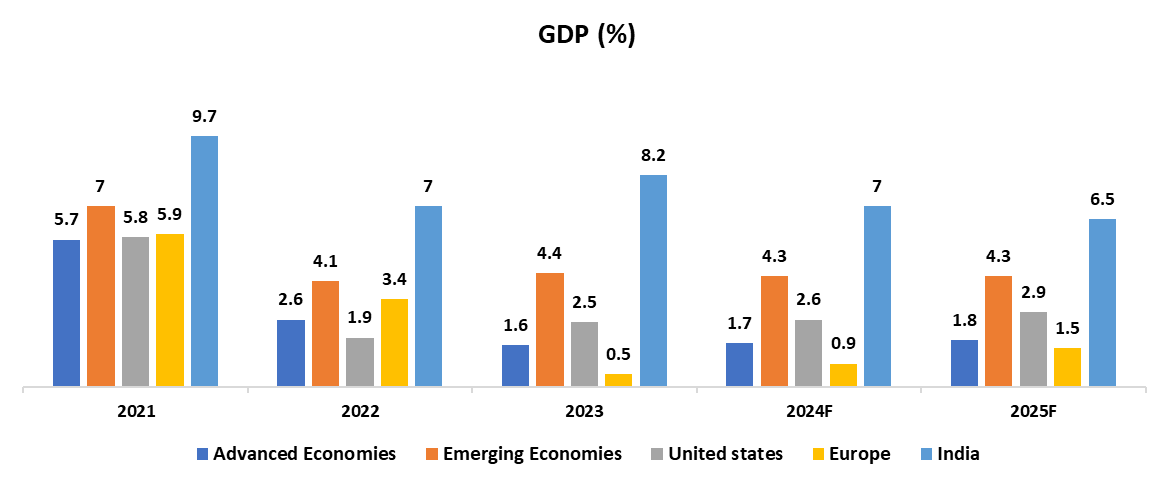

GDP:

Global GDP is projected to grow at 3.2% in 2024 and 3.3% in 2025. The trades have become firm supported by the strong exports from Asia, especially the technology sector. The businesses are majorly on ‘cost-cutting’ projects as the discretionary spendings are still low. Governments are facing fiscal challenges due to higher interest rates, spending on citizen schemes and climate change.

(Source: IMF, World Bank)

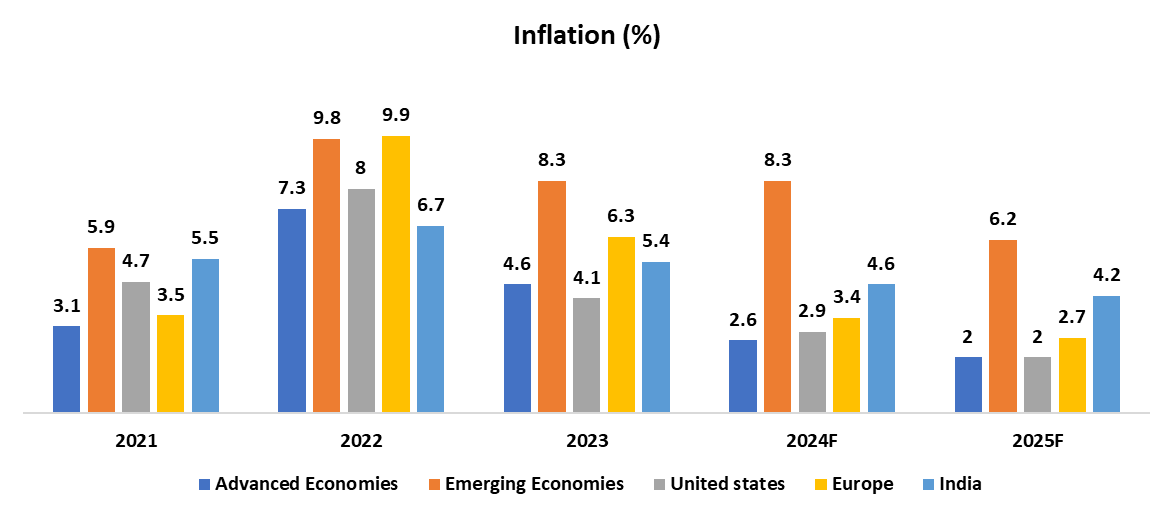

Inflation:

The economy has stayed remarkably resilient and thus, the inflation is coming back to the target level. Even during the high-inflationary environment, the consumption was still on rise especially in the emerging economies. The economy, despite facing deflation and recession warnings, has been growing steadily. Forecasts suggest for inflation to come down from 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025 globally.

(Source: IMF, World Bank)

Industry development and status:

A combination of factors—below-average monsoon, early summer heatwave leading to winter crop failure, and weak rural demand—caused a decline in the farm industry during FY 2023-24.

Tractor sales in India fell to 874,504 units in FY 2023-24, a 7% decrease compared to FY 2022-23.

Unreliable rainfall led to reduced agricultural output, lowering farmers' income and decreasing demand for farm machinery.

Farmers, facing financial strain, were hesitant to invest in new equipment, further weakening the farm sector.

Despite market challenges, the company maintained its leadership in the farm segment through strong sales, marketing, customer collaboration, agility, and operational efficiency.

The average consumer replacement cycle for passenger vehicles is 4 to 5 years, but COVID-19 in FY 2020-21 disrupted this cycle, with higher inflation further reducing discretionary spending.

In FY 2023-24, the company focused on expanding retail operations and extraction efforts to boost volume growth.

The company strategically repositioned its brand in the premium segment by realigning its product portfolio and using technology and analytics to enhance customer engagement and productivity.

Indian Tyre Industry Outlook:

The Indian tyre industry is dominated by the commercial category (Truck & Bus), which accounts for over 50% of industry revenue.

The company has a limited presence in the commercial tyre category, restricting its ability to offer a diverse portfolio and manage risks from the farm category.

Despite these challenges, the company's outlook remains positive.

India's population, the largest globally at 18%, is driving higher demand for agricultural products, with agriculture contributing 18% of the country’s GDP.

Over 50% of India's population relies on agriculture, further boosting the sector's growth.

This growth is leading farmers to adopt newer, advanced technologies to improve productivity.

The farm industry outlook remains positive in the mid to long term (3 to 5 years), and the company maintains its leadership in the farm category, with plans to enhance capacity to meet growing demand.

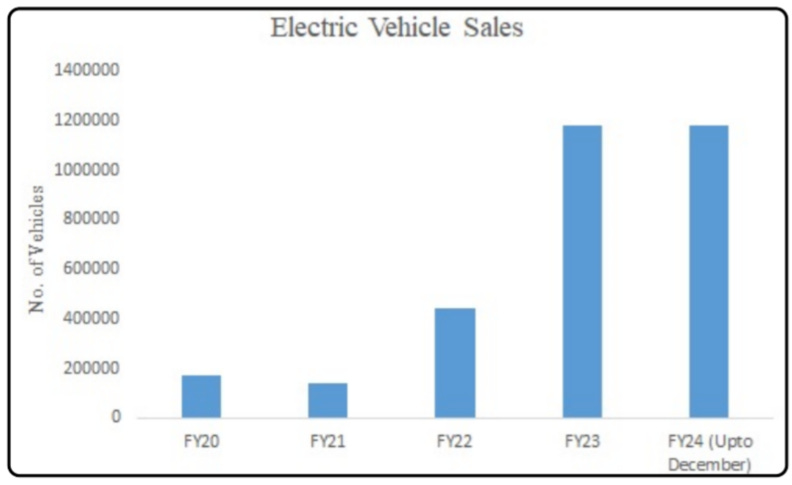

The consumer replacement industry is expected to grow due to increased preference for luxury vehicles, SUVs, and electric vehicles (EVs), leading to higher demand for larger rim sizes.

The company is strategically focusing on premium segments to improve profitability and differentiate itself through technological superiority and top-tier products, aiming to gain market share.

Despite strong competition, the company is focused on expanding its channels and improving services through technology while introducing innovative products in the luxury SUV and EV segments to meet changing consumer demands.

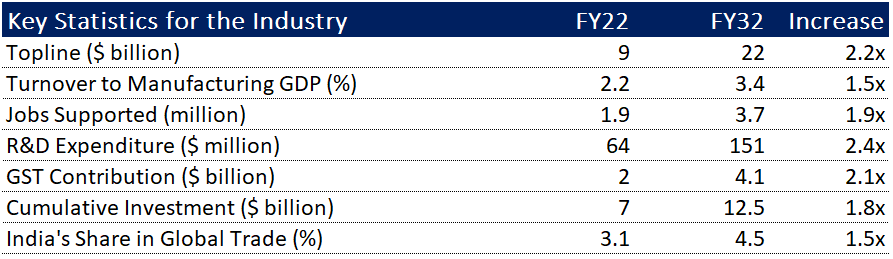

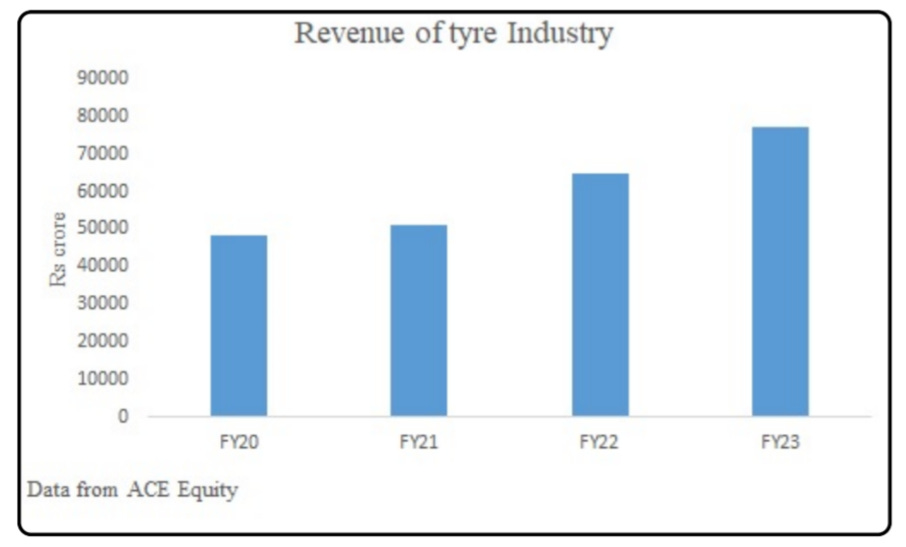

Indian Tyre Industry Revenue:

(Source: Crisil)

Growth Drivers for the company:

Rs.60,000 crores earmarked for FY2024-25 towards Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) Yojana, a flagship scheme of the Government of India aimed at ensuring minimum income support to all eligible landholding farmers' families.

Substantial increase in funding for the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) - an irrigation initiative launched by the Government.

Allocation of Rs. 14,600 crores in FY2024-25 towards Pradhan Mantri Fasal Bima Yojana (PMFBY) - crop insurance scheme.

FY2024-25 outlay of Rs. 7,553 crores under the Rashtriya Krishi Vikas Yojana (RKVY) - to ensure holistic development of agriculture and allied sectors.

12. SWOT ANALYSIS

Strengths

Strong Brand Reputation: Goodyear is a globally recognized brand with a long history and a solid reputation for producing quality tyres.

Diverse Product Range: It offers a variety of tyres, including passenger vehicles, commercial trucks, and agricultural equipment, catering to different market segments.

Technological Expertise: Goodyear is known for its innovation in tyre technology, including advancements in fuel-efficient and high-performance tyres.

Wide Distribution Network: A well-established distribution network across India ensures easy availability of its products.

Weaknesses

Limited Presence in Two-Wheeler Segment: Unlike some competitors, Goodyear India has a weaker presence in the fast-growing two-wheeler tyre market.

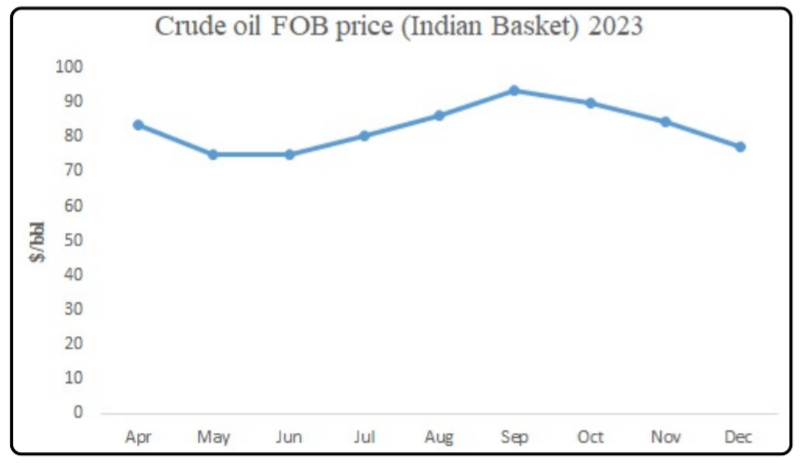

Dependence on Raw Material Prices: Fluctuations in prices of raw materials like natural rubber and crude oil derivatives can impact profitability.

Market Share: In India, Goodyear faces stiff competition from local and international brands, which limits its market share.

Opportunities

Growing Automobile Industry: With the expansion of the automobile sector in India, especially in rural and semi-urban areas, there is a rising demand for both passenger and commercial vehicle tyres.

Electric Vehicle (EV) Market: The growing EV market in India offers opportunities for Goodyear to develop and market specialized tyres for electric vehicles.

Government Initiatives: The Indian government's focus on infrastructure and agriculture development could lead to higher demand for commercial and farm tyres.

Sustainability Trends: Increased consumer demand for eco-friendly products opens the door for Goodyear to capitalize on sustainable and energy-efficient tyre solutions.

Threats

Intense Competition: The Indian tyre market is highly competitive, with strong local brands like MRF, Apollo Tyres, and global players like Bridgestone.

Raw Material Price Volatility: Sudden spikes in raw material costs can affect profit margins.

Regulatory Challenges: Stringent environmental and safety regulations may increase production costs.

Economic Slowdown: Any slowdown in the Indian economy or the global market can reduce demand for tyres, particularly in the commercial segment.

13. Q1 FY25 Latest Concall Analysis

The company do not have a history of doing Concalls.

14. New Initiatives and Opportunities

Product Innovation:

Focus on Luxury and SUV Segments: The company is introducing contemporary products in the luxury and SUV segments to cater to evolving consumer needs.

Electric Vehicle (EV) Focus: The company is also introducing innovative products in the luxury SUV and EV segments, demonstrating a commitment to emerging technologies.

Portfolio Expansion:

Limited Presence in Commercial Tyres: The company acknowledges its limited presence in the commercial tyre category and recognizes the potential for portfolio selling and risk mitigation.

Strategic Initiatives:

Technology Absorption: The company is collaborating with Goodyear's Innovation centers in Akron, USA, to introduce new products that meet OEM requirements and replacement market demands.

Product Enhancement: Existing products are continuously monitored and improved to meet changing customer expectations.

Leadership in Farm Category: The company aims to maintain its leadership position in the farm category through excellent customer service, key account management, and operational excellence.

Channel Expansion: In the farm replacement business, the company is prioritizing channel expansion and engagement to ensure the right tyre is delivered at the right time and cost.

Overall, the company is focused on product innovation, portfolio expansion, and operational excellence to capitalize on emerging market trends and maintain its leadership position. The initiatives in the luxury and SUV segments, along with the focus on technology absorption and customer service, demonstrate a commitment to growth and competitiveness.

15. Competitors in the Market:

MRF Ltd.:

Market leader, strong in passenger cars, two-wheelers, and truck tyres.

Apollo Tyres Ltd.:

Expanding internationally; focuses on passenger, truck, and bus tyres.

JK Tyre & Industries Ltd.:

Known for truck and bus radial tyres.

CEAT Ltd.:

Popular in passenger and two-wheeler segments.

Bridgestone India Pvt. Ltd.:

Premium international brand with a focus on passenger tyres.

16. Industry Overview:

Introduction:

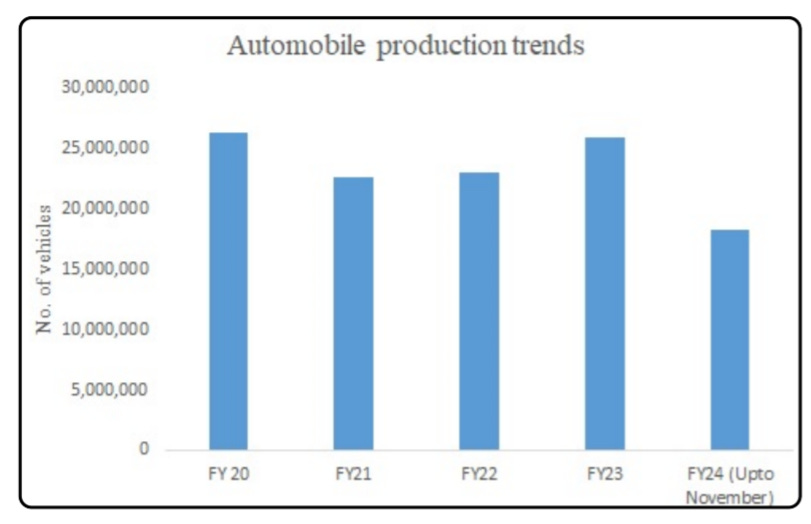

The India tyre market size reached 196.3 Million Units in 2023. Looking forward, IMARC Group expects the market to reach 253.9 Million Units by 2032, exhibiting a growth rate (CAGR) of 3% during 2024-2032. The growing production of automobiles, inflating income levels of individuals, and rising demand for vehicles represent some of the key factors driving the market.

Source - Imarc

Indian Tyre Market Trends:

The rising demand for tyres in India is driven by increasing automobile production and exports, including tractors, buses, trucks, and cars. Higher income levels are boosting car and two-wheeler sales, especially in rural areas where public transport is limited. Tyre demand is further supported by usage across various vehicles, including military and passenger cars. Indian tyre manufacturers benefit from lower logistics costs, making them competitive globally. Automation and advancements in tyre manufacturing present growth opportunities, while government initiatives like Atmanirbhar Bharat Abhiyan further support the sector.

Source - Imarc

Revenue of Industry:

Revenue of Indian tyre industry is expected to more than double in a decade from $9 billion in 2022 to $22 billion in 2032. The higher revenue forecast is due to increasing demand for vehicles and government’s continuous focus on investing in infrastructure. India is among the leading tyre manufacturers globally. Apart from conventional radial and bias tyres, the industry offers advanced smart, noise-reduction, puncture-proof and electric vehicle versions.

Source - sukhanidhi

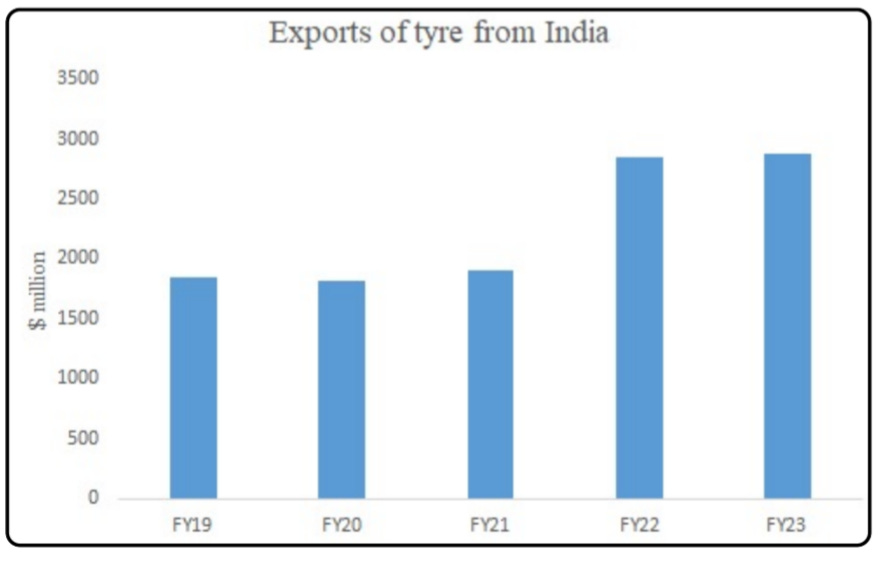

Exports of tyre from India:

Exports of tyre from India are expected to rise in coming future. Tyre exports from India during the FY23 rose by over 1.50 percent at $2884 million as against $2841 million in the year-ago period. Recessionary conditions in some countries, rising interest rates, political turmoil and slowing of external demand affected growth momentum of Indian tyre exports. However, tyre exports from India went up by 49% in FY22 as compared to FY21. Tyres manufactured in India are being exported to over 170 countries including some of the most discerning markets in North America and Europe. The U.S. continues to be the largest market for Indian tyres.

Source - sukhanidhi

Positives for the Industry:

•Rising automobile demand to drive the tyre industry's growth into high-speed lane:

•Rising uses of electric vehicles:

•Stable or fall in crude oil prices:

•Falling Natural rubber prices to improve margins of tyre industry:

17. Government Initiatives / Recent Developments:

•Fresh guidelines for tyre manufacturers by the government:

The Indian tyre industry is experiencing rising demand for both export and domestic markets, driven by increased vehicle ownership, industrialization, and mobility needs for trucks and buses. Growth is further supported by advancements in eco-friendly tyre technology and R&D. Since June 2020, the import of new pneumatic tyres is restricted, requiring importers to apply for a licence. In response to the industry's growth, the Ministry of Commerce and Industry has proposed new guidelines encouraging tyre manufacturers to invest in brownfield or greenfield projects in India.

•Govt extends PLI scheme for automobile, auto components industry by one year:

The Ministry of Heavy Industries has extended the Production Linked Incentive (PLI) Scheme for the Automobile and Auto Components sector by one year, following approval from the Empowered Group of Secretaries (EGoS). The scheme now offers incentives for five consecutive years starting from 2023-24, with disbursements beginning in 2024-25 and concluding by March 31, 2028. The recent amendments aim to enhance clarity and flexibility for participants.

Source - sukhanidhi

Challenges:

Increased Competition:

Growth in production from emerging economies is intensifying competition.

New entrants in the tire industry are creating pricing pressures, impacting profit margins.

Environmental Demands:

Consumers and regulators are pushing for eco-friendly and sustainable products.

Manufacturers must invest in green practices and technology to reduce carbon footprints and meet sustainability standards.

Opportunities:

Market Expansion:

Changes in the tire trade open up access to new geographic markets.

Emerging consumer segments and specialized product categories, like electric vehicle tires, are growing.

Technological Advancements:

Innovative tire designs can meet niche demands, improving product differentiation.

Enhanced production efficiency through technology can lower costs and boost competitiveness.

Sustainability as a Differentiator:

High consumer demand for sustainable, eco-friendly tires allows manufacturers to build a competitive edge.

Companies offering high-quality sustainable products are well-positioned to capture this growing segment.

18. Outlook:

The Indian tyre industry is expected to grow in the coming time on account of increasing demand for vehicles and government focuses on infrastructure development. With the growth and expansion of the automobile sector, demand for replacement tyres is also increasing. Moreover, increasing acceptance of Indian tyres in overseas markets is leading to a sharp growth in tyre exports from India to destinations such as the U.S. and Europe. India-manufactured tyres are being exported to more than 170 countries, with the U.S. and Europe buying the most. The creation of high-speed corridors and the government’s infrastructure efforts will lead to an increase in the use of radial tyres. The shift towards radialisation will provide a further growth opportunity for the industry. Stable or falling crude oil and falling natural rubber prices will help the Industry to improve its margins. Additionally, a large and growing population of vehicles will continue to support tyre demand in the replacement market.

Thank you for reading till the end! We hope you enjoyed this report.

Researched By- Naresh, Mayank and Vaibhav

All information is sourced from company annual reports, Screener.in, industry reports and Economy Outlook reports.

Disclaimer- We do not recommend buying or selling any stock. You should consult your financial advisor before buying or selling any financial instrument.