Welcome to the 8th edition of our small-cap coverage. Today, we're diving into an export-oriented Textile & Apparel company, “S P Apparels Ltd.”. Let's start! But before we do, here is the link to the 7th edition.

We post a new edition every 2nd Saturday. So Subscribe and stay tuned for our upcoming publications on various companies.

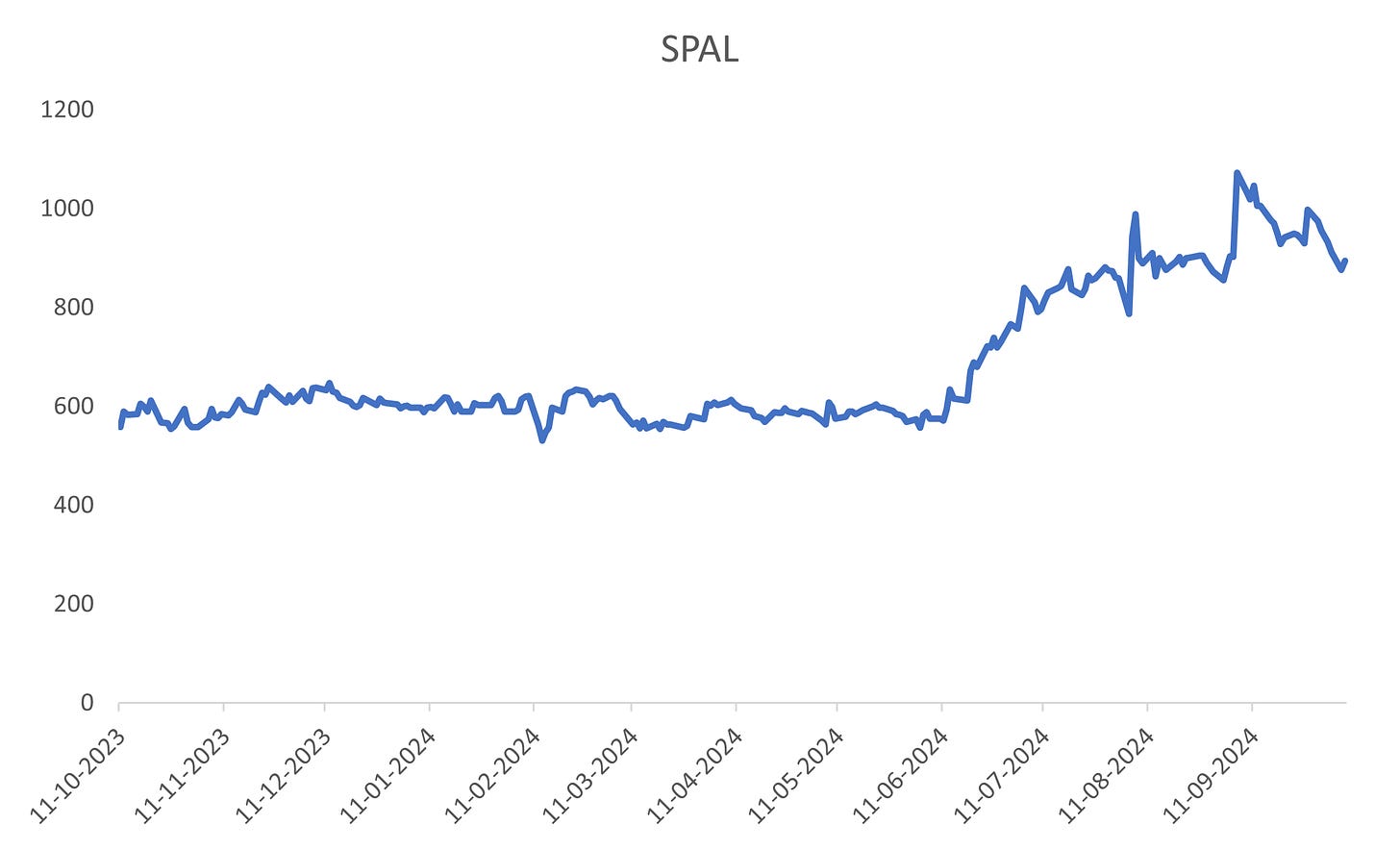

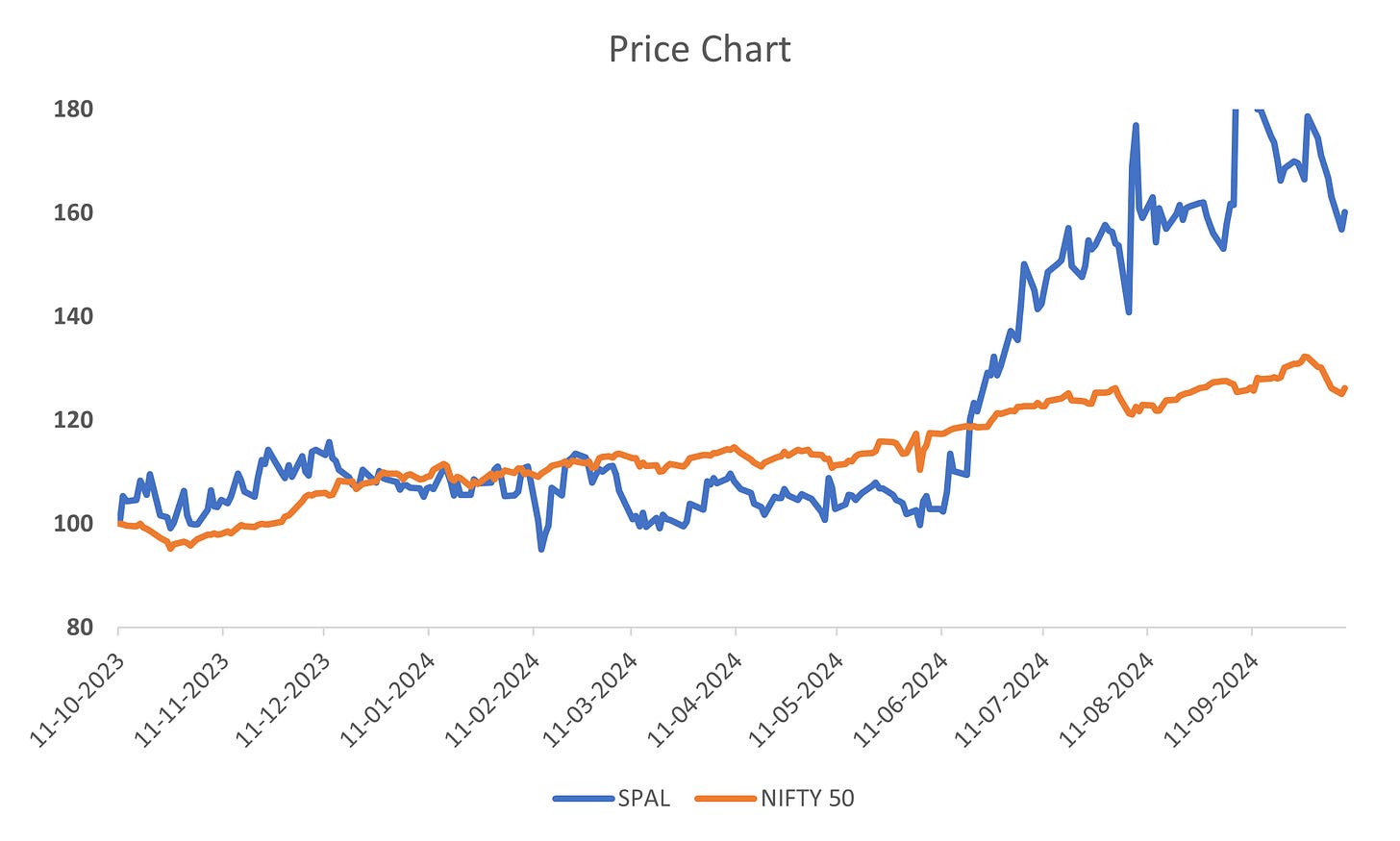

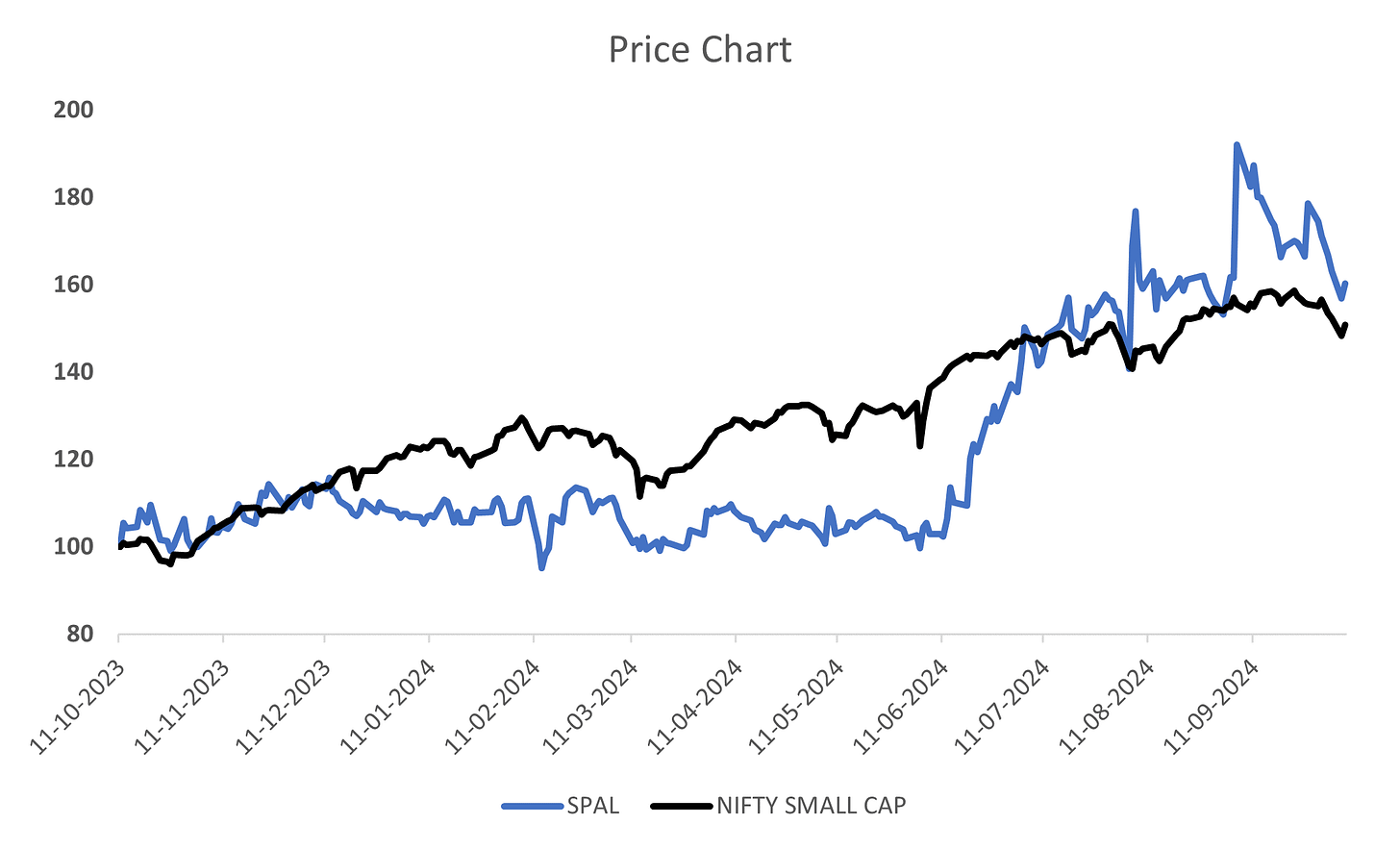

1. Company Share Price chart & comparison with Index:

Comparison with NIFTY50

Comparison with NIFTYSMALLCAP

All above charts are *Indexed on 11 Oct 2023 (=100)

2. About Company:

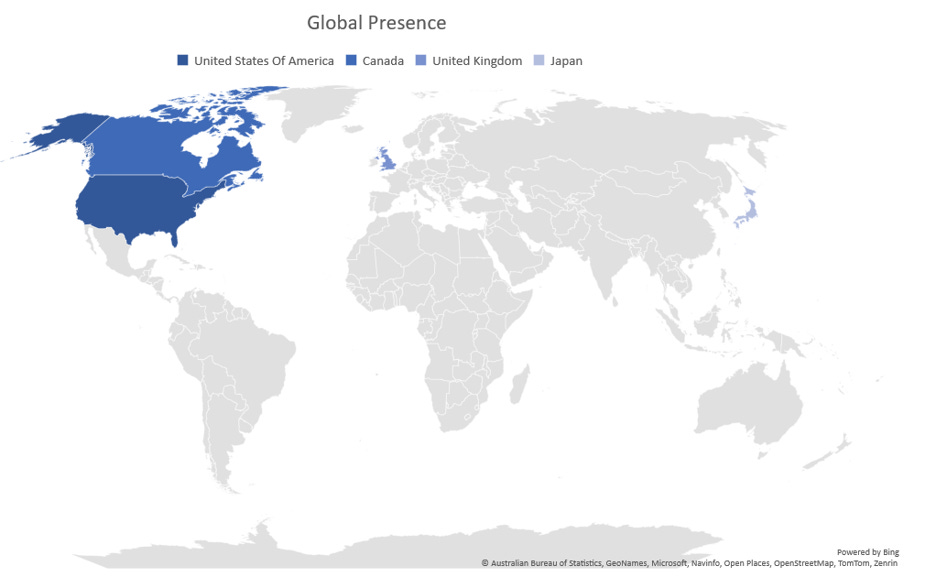

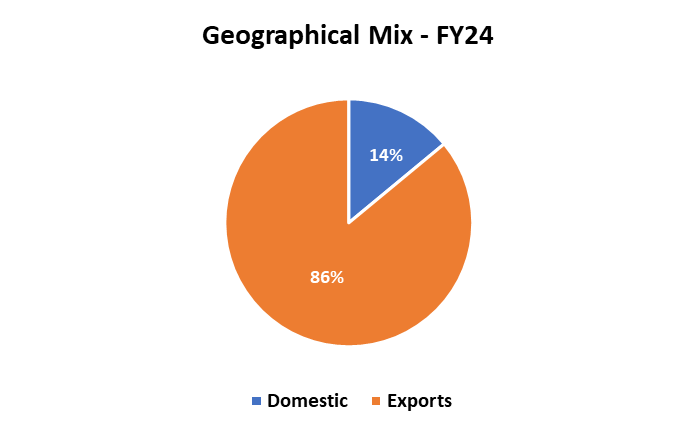

S P Apparels Limited is an Indian company primarily engaged in manufacturing and exporting knitted garments for infants and children. Based in Tamil Nadu, it is a vertically integrated company that controls the entire production process, from yarn spinning to finished garments. Its main products include body suits, sleep suits, tops, and bottoms for kids, which are primarily exported to markets like the UK and Europe. The company also has a domestic business segment focused on branded clothing under the label "Crocodile." S P Apparels has gained a reputation for quality and timely delivery.

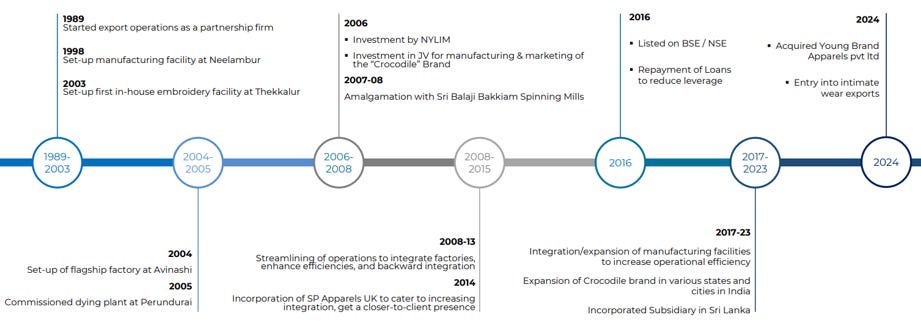

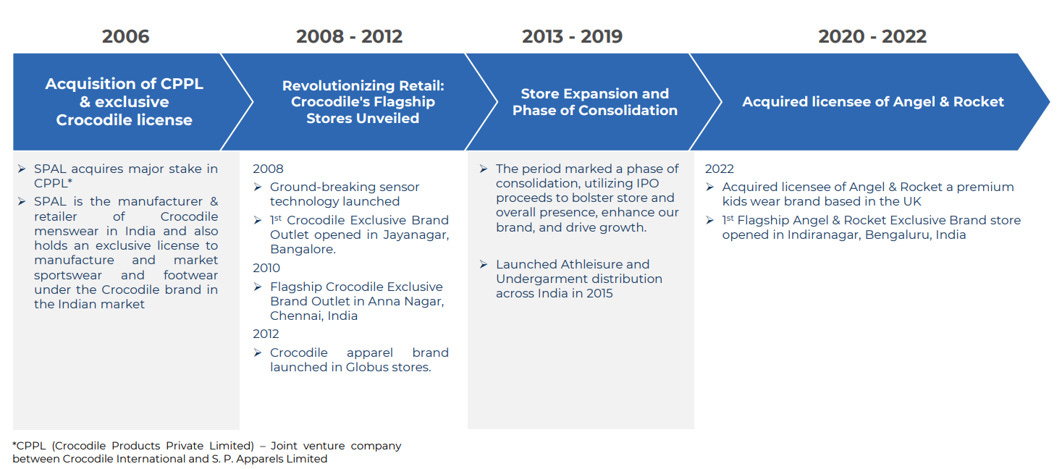

3. Company Journey-

Timeline of the Business

1989: The company was established as a partnership firm and started export operations.

1998: Set up a manufacturing facility at Neelambur. Invested in a joint venture for manufacturing and marketing the "Crocodile" brand.

2003: Set up the first in-house embroidery facility at Thekkalur. Set up a flagship factory at Avinashi.

2004: Commissioned a dying plant at Perundurai. Streamlined operations to integrate factories, enhance efficiencies, and integrate backwards.

2005: Incorporated SP Apparels UK to cater to increasing integration and get a closer-to-client presence.

2006: Investment by NYLIM. Amalgamation with Sri Balaji Bakkiam Spinning Mills.

2007-08: Repayment of loans to reduce leverage. Entry into intimate wear exports.

2008: Listed on BSE/NSE. Integration/expansion of manufacturing facilities to increase operational efficiency.

2014: Expansion of the Crocodile brand in various states and cities in India.

2016: Acquired Young Brand Apparels Pvt Ltd.

2023: Incorporated a subsidiary in Sri Lanka.

Overall, the company has experienced steady growth and expansion over the years, with a focus on improving operational efficiency, expanding its product range, and strengthening its global presence.

Retail Division

Business Presence

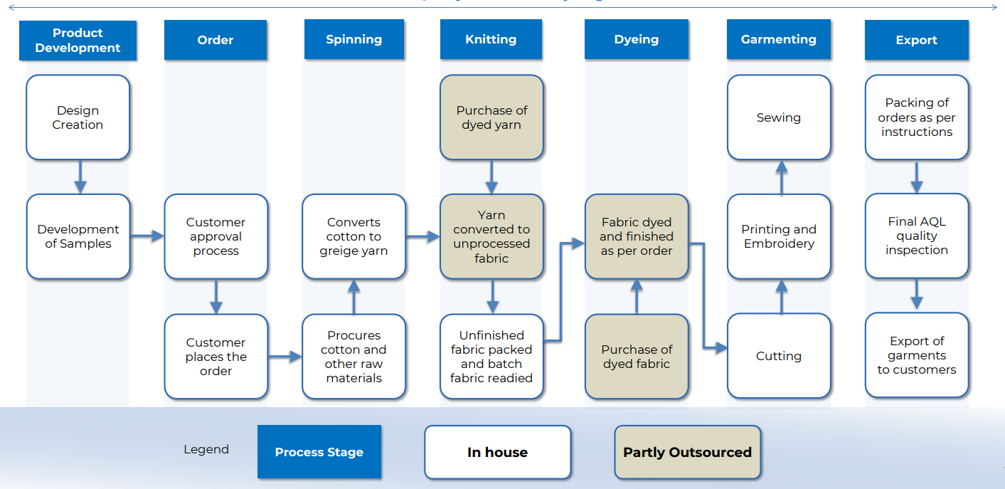

4. Business Model:

S P Apparels (SPAL) operates with a vertically integrated business model in the textile and garment manufacturing industry, meaning they control multiple stages of the production process, from raw materials to finished products. This vertical integration allows the company to manage costs, maintain superior quality, and offer customization to meet specific customer needs.

Core Activities

Product Development:

- Design creation and sample development, ensuring tailored offerings for customer needs.

Order Fulfillment:

- Customer order placement and approval, streamlining the production process to meet demand efficiently.

Manufacturing Process:

- Spinning: Converting cotton to greige yarn.

- Knitting: Converting yarn into unprocessed fabric.

- Dyeing: Dyeing fabric as per customer specifications.

- Garments:

- Printing and Embroidery: Adding finishing details.

- Cutting and Sewing: Producing final garment products.

Export:

- Packing and shipping finished garments to international customers, catering to well-established global brands

Value Proposition

Vertical Integration:

SPAL’s business model offers comprehensive control over every phase of production, from yarn to finished garments, resulting in enhanced quality, cost efficiency, and reduced lead times.

Customization:

The company's end-to-end production capability allows it to offer customized garments that meet the unique specifications of each customer.

End-to-End Solutions:

SPAL provides a complete range of services from raw material procurement, design, and production to shipment, reducing the need for third-party outsourcing and improving operational efficiency.

Key Resources

Manufacturing Facilities:

SPAL operates advanced spinning, knitting, dyeing, and garmenting plants equipped with cutting-edge technology and automation. This infrastructure allows the company to manage large volumes of production with precision.

Raw Materials:

Cotton, yarn, dyes, and other inputs sourced from reliable suppliers ensure consistency in quality.

Human Capital:

The company has a skilled workforce responsible for design, manufacturing, and quality control, ensuring high standards are met across operations.

Technology:

SPAL utilizes modern manufacturing machinery and IT systems to streamline operations, ensuring efficient processes and superior product quality.

Key Partnerships

Suppliers:

Long-term relationships with suppliers provide SPAL with access to quality raw materials and state-of-the-art machinery, enabling continuous production at optimal costs.

Customers:

SPAL has developed strong, enduring relationships with global brands like Marks & Spencer, Jockey, and American Eagle, reinforcing its position as a preferred vendor in the children’s wear and intimate wear segments.

Logistics Providers:

Partnerships with logistics providers ensure smooth export and delivery of products to international markets.

Cost Structure

Direct Costs:

SPAL’s primary costs include raw materials (cotton, yarn, dyes), labor (skilled workers across manufacturing processes), and operational manufacturing expenses.

Indirect Costs:

Overhead expenses, such as administrative costs, technology investments, and marketing, form part of SPAL's indirect costs.

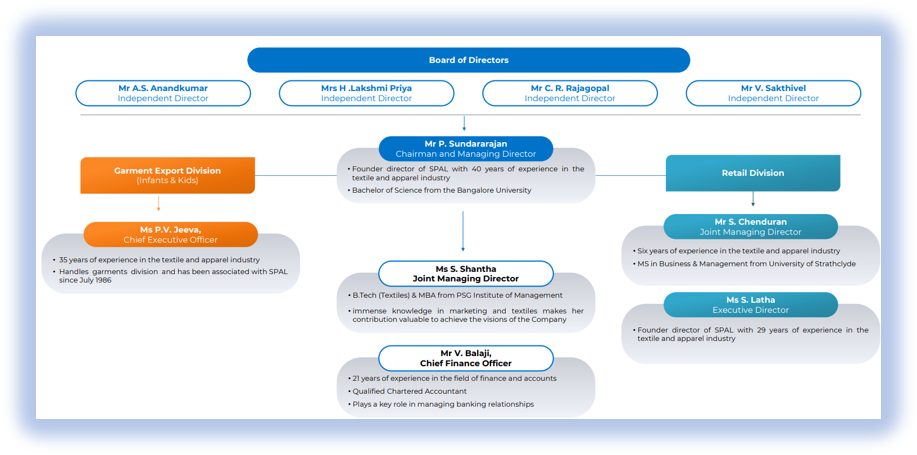

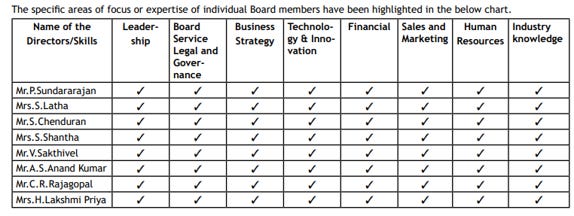

5. Managerial Overview:

Mr. P. SUNDARARAJAN

Designation - Chairman and Managing Director.

Qualification - He holds a Bachelor of Science degree from the Bangalore University.

Experience - Mr. Sundararajan has approximately 31 years of experience in the textile and apparel industry.

Mrs. S. LATHA

Designation - Executive Director.

Qualification - She has completed education up to higher secondary school.

Experience - She has approximately 24 years of experience in the textile and apparel industry.

Mr. S. CHENDURAN

Designation - Joint Managing Director.

Qualification - He holds a Master of Science in Business and Management from the University of Strathclyde, United Kingdom.

Experience - He has approximately three years of experience in the textile and apparel industry.

Mrs. S. SHANTHA.

Designation - Joint Managing Director.

Qualification - She holds a B.Tech (Textiles) and a Master of Business Administration (MBA) from PSG Institute of Management.

Experience - (Not mentioned).

Mrs.P. V. JEEVA.

Designation - Chief Executive Officer.

Qualification - She holds a diploma in textile processing from GRG Polytechnic College, Coimbatore.

Experience - She has approximately 30 years of experience in the textile and apparel industry.

Mr. V. BALAJI.

Designation - Chief Financial Officer.

Qualification - Qualified Chartered accountant.

Experience - He has 16 years of experience in the field of finance and accounts.

Mrs. K. VINODHINI.

Designation - Company Secretary.

Qualification - She holds a Bachelor of Commerce degree from Bharathiar University. She is a qualified Company Secretary.

Experience - She has over Five years of experience in the field of company secretarial functions.

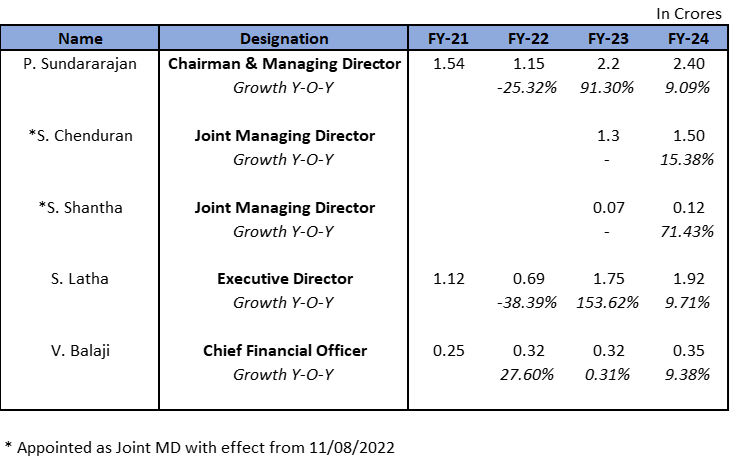

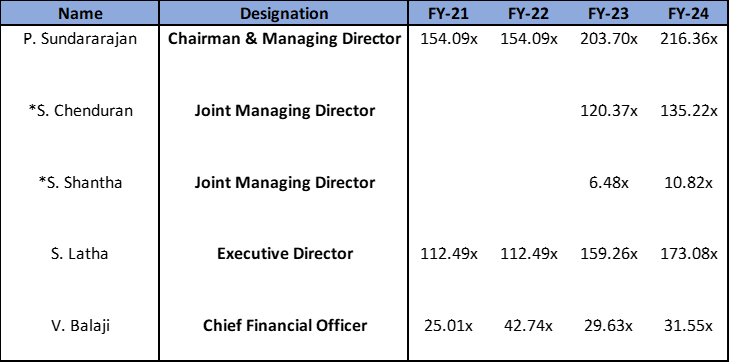

6. KMP’s Remuneration:

KMP Remuneration to Median Employee Remuneration

7. ESOPs:

The Company does not currently have a Stock Option Plan. The management, in the meeting held on 10 August 2024, has proposed to approve and adopt the “SPAL 2024 stock option plan,” under which the number of Equity Shares to be issued and allotted under SPAL ESOP 2024 will be limited to 2,50,000 Equity Shares representing less than 1% of the paid-up equity share capital of the Company.

8. Key Products/ Services:

They are one of India's leading manufacturers and exporters of knitted garments for infants and children. They provide end-to-end garment manufacturing services, from greige fabric to finished goods. Their core strength lies in their deep understanding of the specifications required for knitted garments.

Brand Portfolio:

1. HEAD: HEAD is an international brand known for premium sports equipment and apparel. Under SP Retail Ventures Limited, SP Apparels has added HEAD to its portfolio, bringing global-quality sportswear and activewear to the Indian market. The brand is synonymous with passion for sports and is widely regarded for its innovative designs and top-tier athletic gear.

2. Angel & Rocket: Angel & Rocket is a children's fashion brand offering stylish and trendy clothing for kids. With a presence in 49 large-format stores and 4 standalone stores, the brand focuses on creating modern, comfortable, and high-quality apparel for children, catering to fashion-forward parents looking for premium kidswear.

3. Natalia: Acquired from Chennai-based SM Apparels, Natalia is a niche brand designed to cater to Indian women aged 20-35, offering Western wear with a unique ethnic flair. This brand targets upwardly mobile, fashion-conscious women who appreciate clothing that blends modern style with traditional influences, positioning it as a premium option in the women's wear segment.

4. Crocodile: Crocodile is a well-established brand with a strong presence in India, operating 54 standalone stores across the country. It is recognized for its high-quality men's apparel, including casual and formal wear, often targeting a premium customer base. The brand is known for its timeless designs and comfortable fits, appealing to urban consumers.

9. Revenue/ Turnover Analysis:

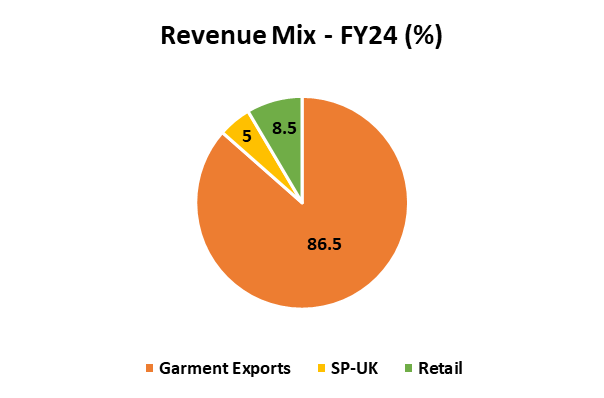

The company has 3 segments:

1. Garment Division: This division focuses on offering knitted garments for infants and children in India, positioning the company as a leading manufacturer and exporter in this segment.

2. Retail Division: The company has spun off its retail division into a separate entity and expanded its portfolio with two additional brands. These include a children's brand, Angel & Rocket, and a premium brand under S P Retail Ventures Limited (a subsidiary). Additionally, the international brand "HEAD" has been included under the Retail Ventures portfolio.

3. SP-UK: Established in 2014, SP-UK was formed to explore marketing opportunities and engage in trading with new customers across the United Kingdom, Ireland, and other European markets.

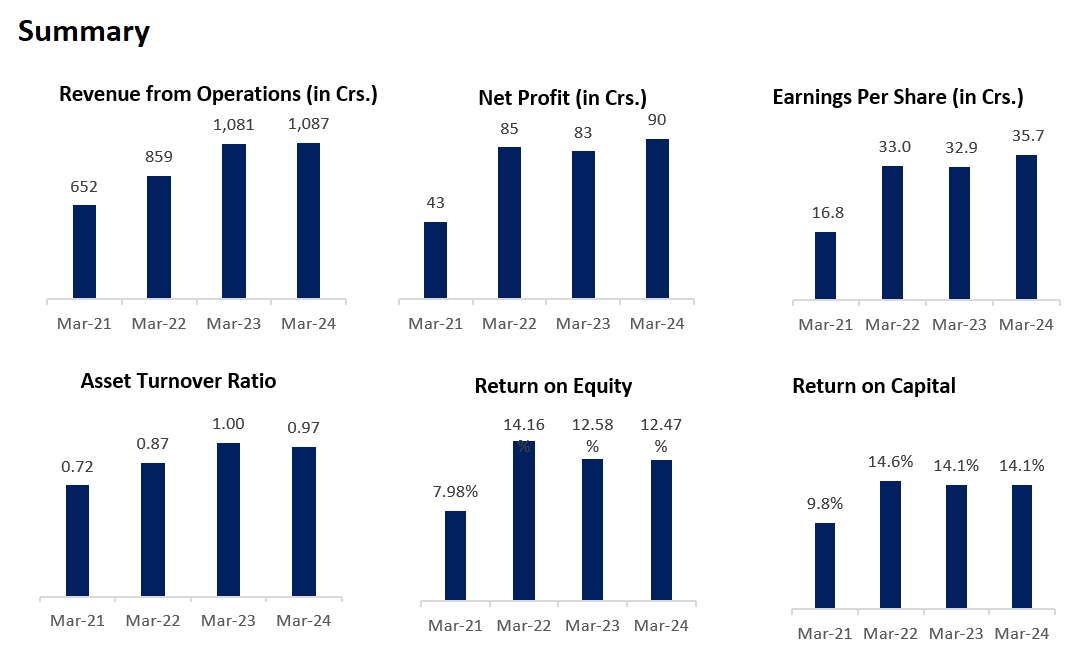

10. Company’s Financial Analysis:

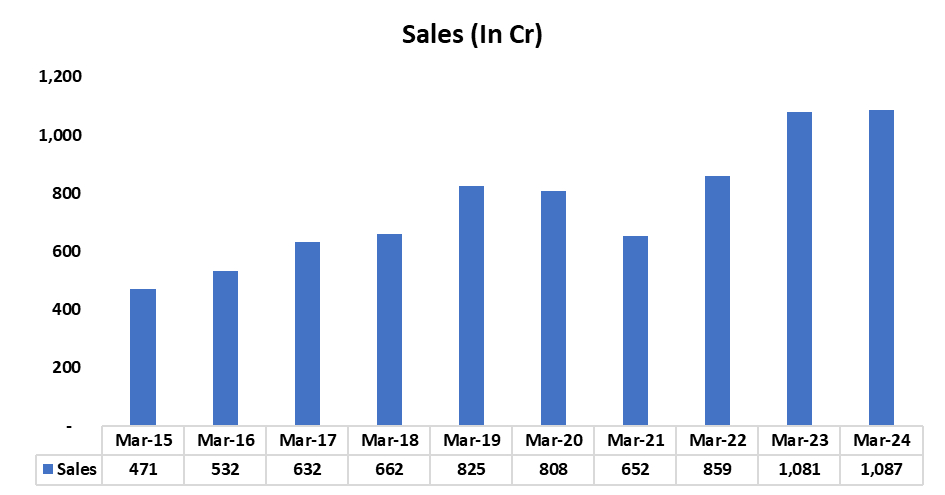

SALES

The Sales have grown at a CAGR of ~10% in the past 10 years.

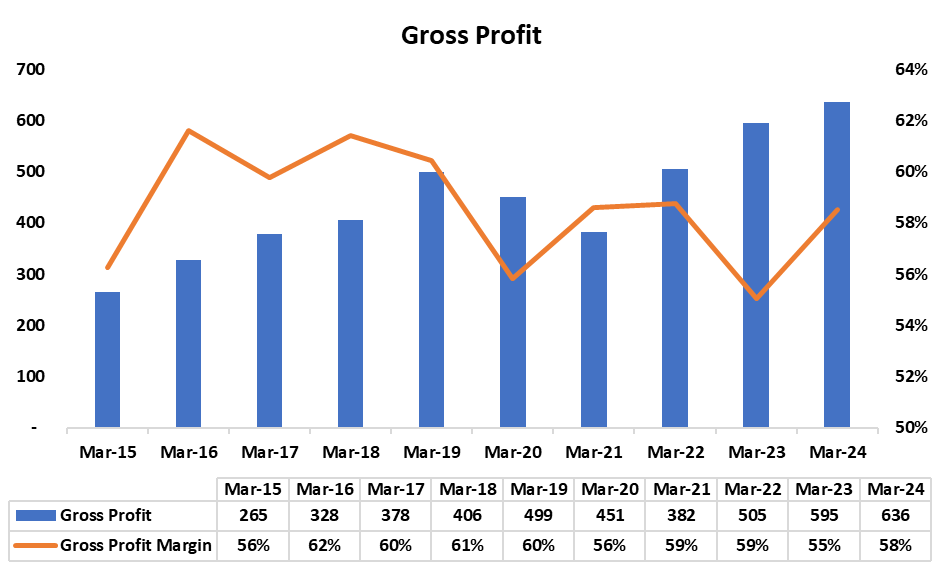

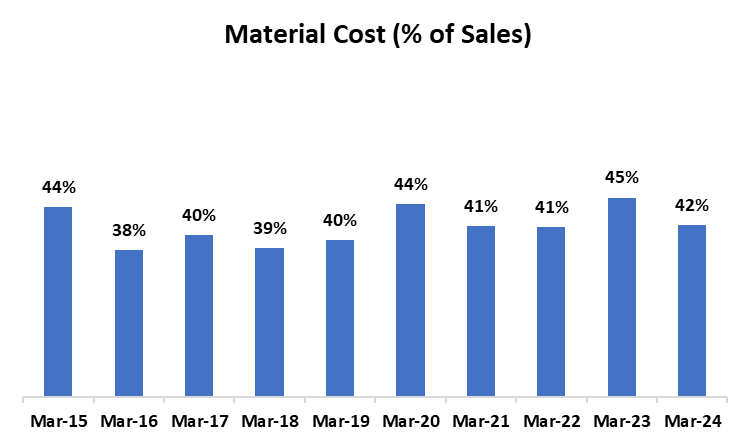

Gross Profit Margin %

The gross margins have fluctuated for the past 10 years mainly due to changes in Material costs. The margin saw a dip in FY23 due to the Increased cost of materials but has bounced back since then.

As per the management, the cost of Materials (yarn) has come to normal levels and not many fluctuations are expected in the future.

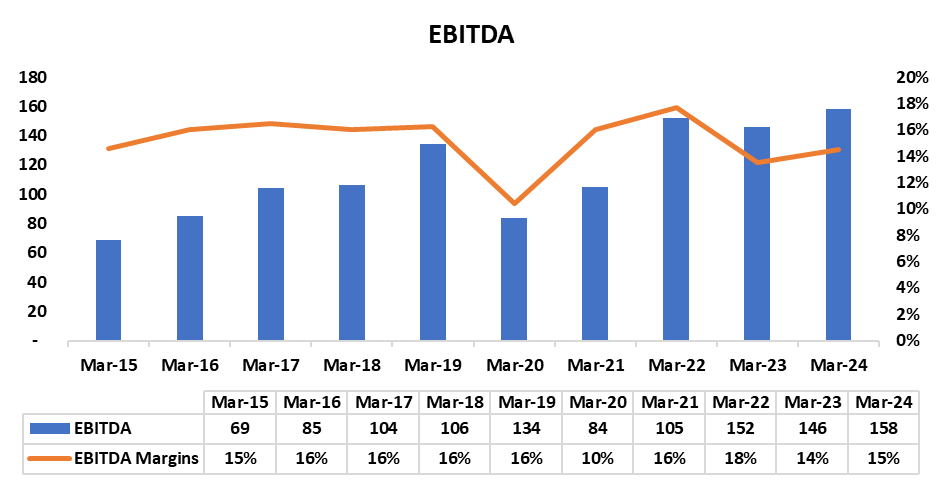

EBITDA Margin %

EBITDA has been rising continuously. The margin has been stable for the past 10 years.

Net Profit Margin %

The company has been able to continuously increase its Net profits along with the margin expansion.

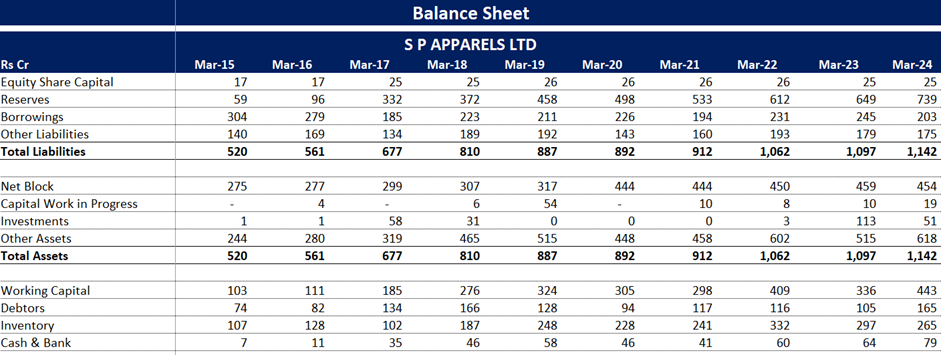

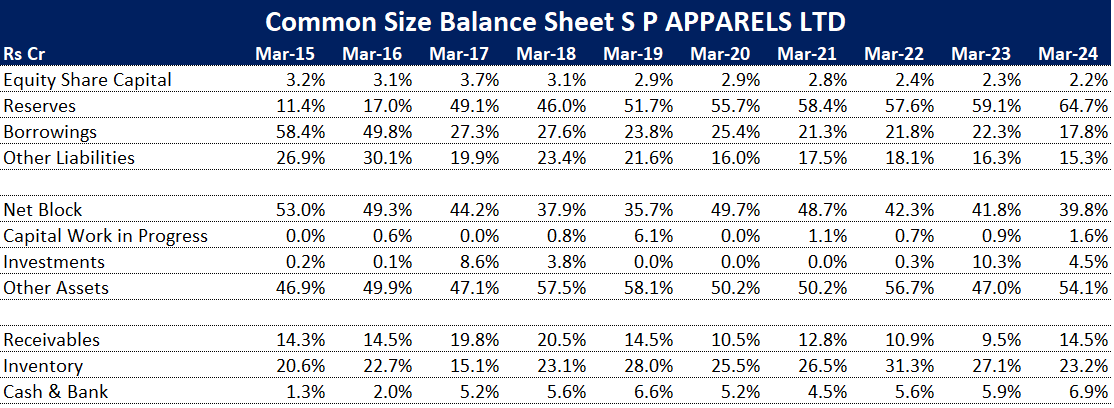

BALANCE SHEET:

If we look at the common size balance sheet, we can notice that the borrowings have come down significantly. Further:

Long-term borrowings have come down from 73cr in 2015 to 6cr in 2024.

Short-term borrowings have been stable.

Both Receivables (as % of Revenue) and Inventory (as % of Revenue) has been stable showing no negative sign.

The company is making purchases in Plant & machinery, furniture and fittings, land etc as a part of the expansion plan.

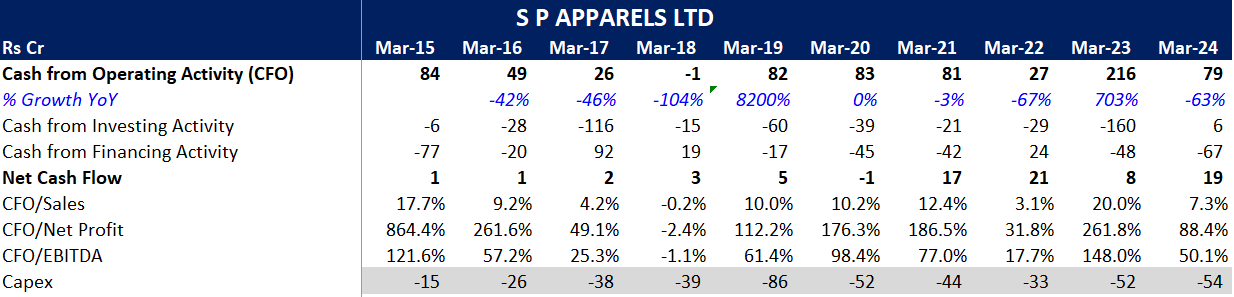

Cashflow Statement:

The company has made some noticeable capex in the past.

Fluctuation in the CFO in FY23 is majorly due to working capital changes.

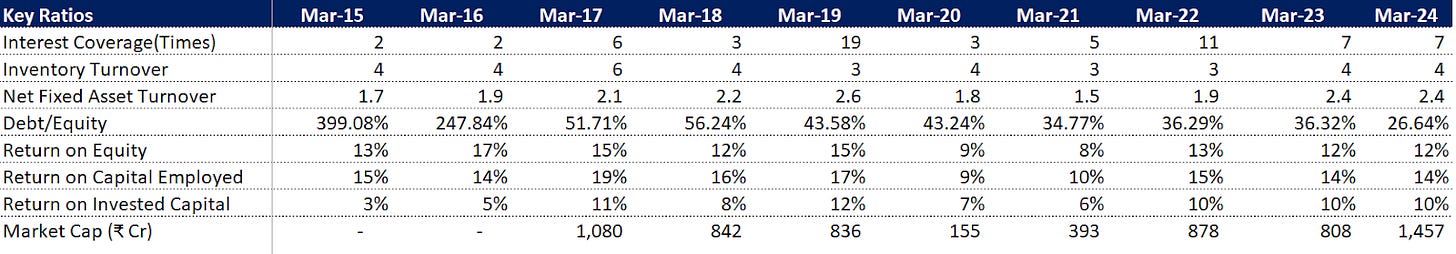

KEY Ratios:

Interest Coverage has improved.

Debt to Eq has come down from 51.71% in FY2017 to 26.64% in FY2024 which is a positive sign.

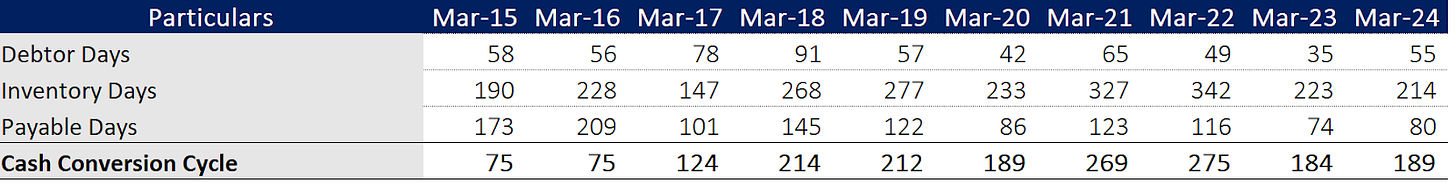

Cash Conversion Cycle:

The inventory days have increased.

Payable days have decreased by 50%.

Overall, the cash conversion time has increased which is not a good sign.

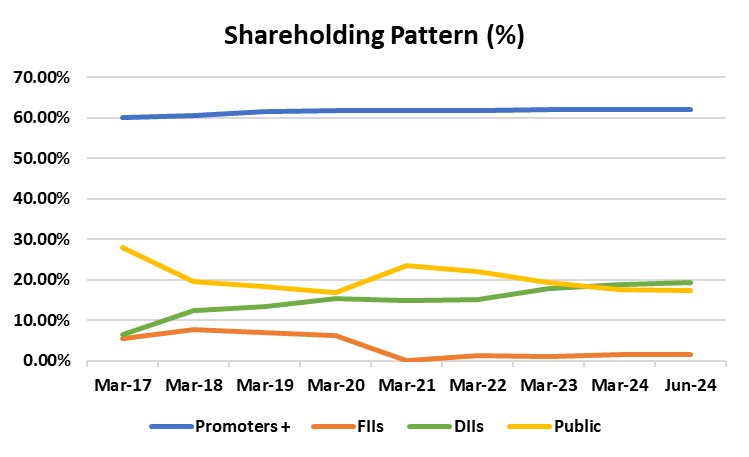

11. Shareholding Pattern:

FIIs and the Public have reduced some holdings which have been absorbed by the DIIs.

12. MD&A:

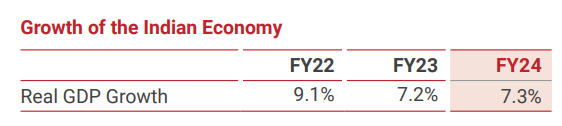

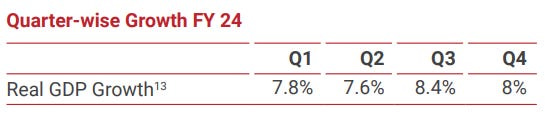

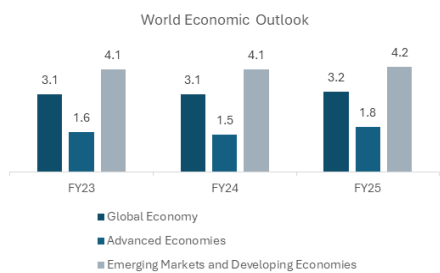

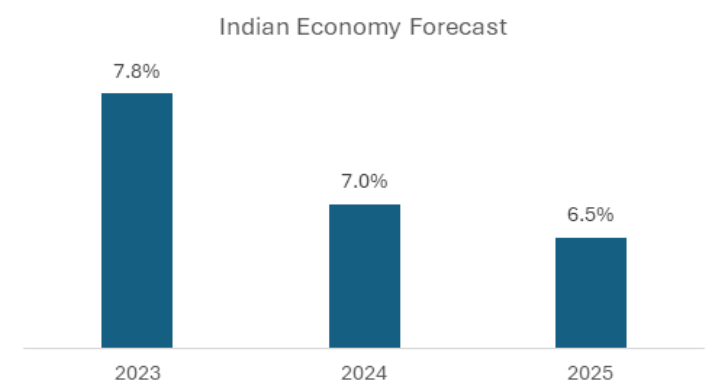

Indian Economy:

India projected the highest annual growth rate among the major global economies, 7.3%, for the fiscal year ending in March 2024. India's big economy continues to expand at the quickest rate in the world. (Source: The Economic Times)

(Source: The Economic Times)

(Source: PIB)

Global Textile Outlook:

The global apparel market is growing at a CAGR of 8%, projected to reach $656 billion by CY 2024.

Growth driven by economic expansion in emerging markets, increased FDI, synthetic fibre demand, and tech advancements.

Global textiles and apparel trade is expected to grow from $942 billion in CY2022 to $1,284 billion by CY2028, with a CAGR of 5.5%.

Emerging economies like Vietnam and Bangladesh will see strong CAGRs of 4.2% and 7.7%, respectively, from CY2023 to CY2028.

China's textile export share (31%) is declining due to rising costs, benefiting Bangladesh and Vietnam.

The EU aims to ensure sustainable textile production by 2030, prompting brands to adapt to this shift.

Inflation and recession in the US and EU have subdued demand, creating opportunities to diversify supply chains away from China.

Indian Textile Outlook:

As of 2023, the Indian Textile and Apparel (T&A) Industry is valued at USD 165 billion, with 76% from domestic sales and 24% from exports.

India is the second-largest producer and the largest exporter of textiles and garments globally.

The domestic T&A industry grew by 7% and is projected to expand at a rate of 10%.

The export market has achieved a 4% CAGR since 2010 and is expected to grow at 10% until 2031.

In the first half of 2022, exports nearly hit an all-time high before declining significantly in the latter half.

T&A exports reached USD 28.72 billion in FY24.

India has established Free Trade Agreements (FTAs) with the UAE, Australia, and Canada.

The industry employs 45 million people, making it the second-largest employer after agriculture.

Competitive advantages include robust market demand, skilled manpower, and lower production costs compared to other textile-exporting countries.

From April to June FY24, exports of 247 technical textile items totaled USD 715.48 million.

The industry benefits from supportive regulatory policies, including a 100% FDI allowance in textiles.

Investment in the sector is increasing, with the government approving USD 7.4 million for R&D projects in June 2023.

The Amended Technology Upgradation Fund Scheme aims to stimulate investment and enhance private equity and employment in the T&A industry.

Global Apparel & Retail Outlook:

The global apparel market is experiencing significant growth, with an anticipated CAGR of 8%.

Key drivers include strong economic growth in developing nations, rising foreign direct investments, higher demand for synthetic fibres, and technological advancements.

The global textiles and apparel trade is projected to grow from $942 billion in CY2022 to $1,284 billion by CY2028, with a CAGR of 5.5%.

Companies are increasingly establishing manufacturing facilities closer to consumer markets, leading to shorter lead times, reduced transportation costs, and improved supply chain transparency.

There is a growing emphasis on trade practices among politically and economically allied countries to mitigate geopolitical risks.

These trends highlight the need for flexibility and adaptability in modern manufacturing, which is fueling growth in the apparel market.

Indian Apparel & Retail Outlook:

The Indian apparel retail sector is expected to grow significantly, reaching a projected value of $89,219 million by 2027, marking a 48.7% increase from 2022.

This growth is anticipated to occur at a CAGR of 8.3% from 2022 to 2027.

A major driver of this expansion is the increasing entry of international brands and retailers into the Indian market through various collaborations.

International apparel brands like Hugo Boss, Diesel, and Kanz have already begun operations in India.

India's strong garment and textile exports, alongside rising disposable incomes and growing consumer demand for sustainable and ethical fashion, are supporting the industry's growth.

Additionally, India has a comparative advantage due to its skilled workforce and lower production costs, positioning the country as an attractive hub for apparel production and retail.

13. SWOT ANALYSIS

Strengths

Established Market Presence: S.P. Apparels has a strong foothold in the garment and textile industry, especially in the children’s apparel segment, with a long-standing reputation for quality.

Diverse Product Portfolio: The company’s expansion into adult wear and innerwear, along with its core children’s wear products, helps diversify revenue streams.

Global Clientele: The company benefits from an international customer base, including clients from Europe and the U.S., supported by its focus on exports.

Backward Integration: S.P. Apparels’ backward integration into spinning and dyeing allows greater control over the supply chain, improving cost efficiency.

Strategic Expansion: Expansion into Sri Lanka and capacity growth in regions like Sivakasi ensure the company is positioned for future growth.

Sustainability Initiatives: Aiming for carbon neutrality by 2033, the company is adopting green practices, which could boost its brand image and attract eco-conscious clients.

Weaknesses

Dependence on Exports: A large portion of the company's revenue comes from international markets, making it vulnerable to global economic fluctuations and currency risks.

High Debt Levels: The company has a significant level of debt, which has increased due to recent acquisitions, such as Young Brand. This could impact cash flow if not managed efficiently.

Low Retail Division Performance: The retail division has struggled, with brands like "Head" being discontinued due to poor performance, affecting overall profitability.

Capacity Utilization Lag: Current capacity utilization stands below optimal levels, and challenges in ramping up labor and production efficiency slow growth in key facilities like Sri Lanka and Sivakasi.

Opportunities

China Plus One Strategy: As global supply chains shift away from over-dependence on China and Bangladesh, S.P. Apparels is well-positioned to capture new orders from international clients.

Growing Demand for Premium Garments: The company's expansion into premium segments like adult wear and innerwear presents opportunities to tap into higher-margin products.

Cross-Selling with Acquisitions: The acquisition of Young Brand offers opportunities for cross-selling and leveraging existing client relationships to boost sales across divisions.

Emerging Markets: The growth in demand from tier-II and tier-III cities in India, driven by rising disposable incomes and improving infrastructure, can spur domestic sales growth.

Focus on Sustainability: The company’s focus on sustainability initiatives could attract more environmentally conscious consumers and international retailers focused on green practices.

Threats

Global Economic Volatility: Any downturn in the global economy or changes in trade policies could adversely affect demand for exports, which is a significant revenue source for the company.

Intense Competition: The apparel industry, both locally and globally, is highly competitive, with players from Bangladesh, Vietnam, and other emerging markets offering cost advantages.

Raw Material Price Fluctuations: The company faces risks from fluctuating cotton and raw material prices, which could erode margins, especially in the spinning and dyeing segments.

Labour Availability: As noted in the conference call, labor challenges and inefficiencies can slow production, especially in regions dependent on migrant workers. Expanding labour shortages could hinder growth.

Regulatory Risks: Changes in international trade regulations, tariffs, or local labour laws in operating regions such as Tamil Nadu and Sri Lanka could increase operational costs and impact profitability.

14. Q1 FY25 Latest Concall Analysis

1. Industry and Market Trends

Global Supply Chain Shifts: Due to the "China Plus One" strategy and political instability in Bangladesh, global clients are diversifying their sourcing to India, Sri Lanka, and other regions.

Growth Potential: These shifts benefit S.P. Apparel as customers increase orders and diversify their supply chains.

2. Operational Performance

Garment Division:

Revenue: ₹214 crore with EBITDA of ₹36 crore (EBITDA margin: 17%).

Utilization: 79.8% in Q1 FY25.

New Facilities: 400 machines are planned for a new facility in Sivakasi by H2 FY25.

Product Expansion: Addition of adult wear products to the portfolio.

Spinning Division:

Challenges: Fluctuating cotton prices, but balanced costs are expected to maintain consistent EBITDA.

Sri Lankan Subsidiary:

1,000 machines are expected by the end of FY25.

Revenue Contribution: Positive returns from new clients; significant business expected from large clients.

Young Brand Acquisition:

Revenue target of ₹300 crore for FY25.

Expected EBITDA contribution: ₹32-35 crore.

3. Financial Performance

Revenue:

Standalone: ₹214 crore.

Consolidated: ₹245 crore (YoY growth: 1.1%).

PAT:

Standalone: ₹22 crore.

Consolidated: ₹18.1 crore (YoY growth: 20%).

Debt: Gross debt at ₹189 crore, net debt at ₹162 crore, increased due to the Young Brand acquisition.

4. Retail Division

Revenue: ₹14.8 crore in Q1 FY25, similar to Q1 FY24.

Profitability: Discontinued the "Head" brand due to unprofitability; focus shifted to the profitable "Crocodile" brand and children’s brand "Angel & Rocket."

Outlook: Retail division is expected to achieve breakeven by FY25-end.

5. Expansion and Growth Plans

Capacity Expansion:

New factory in Sivakasi and increased production in Sri Lanka.

90% utilization of garment division capacity expected by FY25-end.

Cross-Selling: Leveraging the Young Brand acquisition to introduce new clients from the U.S. and Europe.

Long-term Strategy: Expansion focused on both organic growth (new projects) and inorganic growth (acquisitions like Young Brand).

6. Sustainability Initiatives

Carbon Neutrality: The goal is to achieve carbon neutrality by 2033, focusing on reducing greenhouse gas emissions and improving energy efficiency.

7. Outlook

Growth Drivers: Increasing capacity utilization, expanding operations in Sri Lanka, and revenue growth from new and existing customers.

Positive Future: Expecting better performance in Q2 and significant growth from Q3 onwards.

15. New Initiatives and Opportunities

Expansion into the Adult Wear Market:

- The company has diversified its product offerings by entering the adult wear market, broadening its scope beyond existing categories.

New Production Facility in Sivakasi:

- The company is boosting production with a new facility in Sivakasi, which will introduce 400 machines in the second half of FY25. This will further enhance capacity and operational efficiency.

Expansion in Sri Lanka:

- The company’s Sri Lankan subsidiary is already delivering positive results. By the end of FY25, the goal is to have 1,000 machines in operation, reflecting a significant increase in production capacity.

- The company is also negotiating with two new customers for additional orders, creating further growth opportunities with major clients.

Shift in Global Sourcing Strategies:

- European customers are reassessing their sourcing strategies, moving production away from Bangladesh due to political instability, labor issues, and other risks. This presents a significant opportunity for the company as these customers shift production to India, Sri Lanka, Vietnam, and Cambodia.

- The company plans to capitalize on this trend by gaining business in India and Sri Lanka, positioning itself as a stable alternative to countries like Bangladesh and China.

16. Key Drivers

China Plus One Strategy and Political Unrest in Bangladesh:

- The ongoing China Plus One strategy and political instability in Bangladesh are prompting global clients to diversify their supply chains. This trend is creating a favorable environment for India, Sri Lanka, Vietnam, and Cambodia, allowing the company to gain new business opportunities as clients seek alternative sourcing locations.

Increased Production Capacity:

The company is strategically maximizing the utilization of its current capacities and expanding into new markets, such as Sri Lanka, to cater to the rising demand. The company is also increasing capacity by 75 to 100 machines monthly, targeting 90%- 95% capacity utilization by the third quarter.

Expansion into Sri Lanka:

- The company has established a subsidiary in Sri Lanka, which benefits from duty-free status and abundant labor availability. This location is attracting significant interest from customers, which will drive growth in the coming years.

Growth in Retail and S.P. U.K. Division:

- The company anticipates gradual growth in its Retail and S.P. U.K. division, adding to overall revenue streams in the future quarters.

Favorable Market Trends:

- With shifting global market trends in apparel sourcing, the company is well-positioned to capitalize on new business opportunities and is optimistic about growth in future quarters, driven by supportive market conditions.

17. Growth Guidance by Management

EBITDA Growth:

The company aims to improve its EBITDA margin to 15% to 18%, highlighting opportunities for margin improvement by correcting operational lapses.

- For the Young Brand, the company projects EBITDA to contribute INR 32 crores to INR 35 crores for the current financial year.

Revenue Growth from Young Brand:

The company expects INR 300 crores in revenue from the Young Brand during the current financial year, which will contribute significantly to the top line.

Adult Category Revenue Growth:

- The revenue from the adult garment category is expected to increase from 15% to possibly 20% by the third quarter.

Potential for Improvement:

- Management believes they can improve margins by an additional 3%-4% through operational optimizations, enhancing overall profitability.

18. Competitors

Aditya Birla Fashion and Retail Ltd. (ABFRL).

A leading player in the Indian fashion industry, managing brands like Pantaloons, Van Heusen, and Allen Solly. It is listed on both BSE and NSE

2. Arvind Fashions Ltd.

A major player that operates brands like Tommy Hilfiger, Calvin Klein, and Arrow. It is listed on BSE and NSE.

3. Trent Ltd.

A part of the Tata Group, Trent operates Westside and ZARA (in partnership with Inditex). It is listed on BSE and NSE.

4.Benetton India Pvt. Ltd.

The Indian subsidiary of Benetton Group, a global fashion brand known for its colorful, casual clothing. Benetton has been operating in India for decades, targeting a youthful and trendy market.

5. Mothercare (India) Ltd.

An international retailer specializing in products for mothers, babies, and young children, offering maternity wear, baby gear, and children’s clothing.

19. Industry Overview.

Indian kids apparel market -

The Indian kid’s apparel market size reached USD 21.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 26.5 Billion by 2032, exhibiting a growth rate (CAGR) of 2.28% during 2024-2032. Escalating population, huge consumer base, surging disposable income, and adoption of promotional strategies by the manufacturer are some of the key factors propelling the market growth.

Data source - imarc

Indian kids apparel market trends -

•Rising Disposable Income and Changing Consumer Preference:

For instance, in 2023-2024, the per capita disposable income in India reached approximately Rs 2.14 lakh. Moreover, per capita disposable income rose 8% in FY24. Moreover, as disposable incomes rise, parents have more purchasing power, allowing them to spend more on items such as clothing for their children.

•Increasing Urbanization and Escalating Number of Retail Stores:

Urbanization in India is on the rise, with more people migrating from rural areas to urban cities in search of better opportunities. Urban areas tend to have higher purchasing power and greater exposure to fashion trends, leading to an increased demand for kids apparel. For instance, according to the article published by migration portal, the proportion of the world's population living in urban regions is anticipated to rise from 55% in 2018 to 60% by 2030. Moreover, as urban areas grow, there's a corresponding expansion of retail infrastructure, including shopping malls, department stores, and specialty stores.

•Brand Visibility and Marketing Campaigns:

Digital marketing is crucial for reaching a wide consumer base, with brands using platforms like Facebook, Instagram, and YouTube to engage parents and run promotional campaigns. In March 2023, FirstCry.com partnered with KlugKlug to enhance influencer marketing by providing accurate insights on Indian influencers. Innovative campaigns for kids are also positively impacting the market.

Growth Drivers -

• Increase in kids’ population: As India’s overall population surges, the proportion of 0-14 year-olds has reached approximately 26%, generating a substantial demand for products catering to this age group. Additionally, the frequent outgrowth of children from their clothing contributes to a significantly high replacement cycle within the kids’ clothing segment.

• Greater disposable income: The increased financial flexibility of Indian families, along with changing lifestyles, is prompting parents to invest more in their children’s clothing, preferring the latest fashion and branded apparel. This increased willingness to spend on high-quality and stylish clothing for their kids is contributing to the growth of the market.

• Introduction of online retailing: Online shopping provides the convenience of exploring a diverse range of products, comparing prices, and making purchases from the comfort of home, which is particularly appealing to busy millennial parents.

Source - imarc

India Kids Apparel Market Segmentation -

Breakup by category:

Uniforms

T-shirts/Shirts

Bottom Wear

Ethnic Wear

Dresses

Denims

Others

In India's kids apparel market, demand for school uniforms remains stable due to school policies, while t-shirts are popular for comfort among the younger population. Bottom wear like trousers and jeans sees steady demand year-round, influenced by fashion trends and seasons. Ethnic wear sales peak during festive seasons such as Diwali and Eid, while demand for dresses fluctuates with fashion trends and seasons, with summer and party dresses gaining popularity during warmer months and special occasions.

Breakup by Season:

Summer Wear

Winter Wear

All Season Wear

All-season wear plays a key role in India's kids apparel market due to the country's diverse climate. Lightweight cotton T-shirts, jeans, and versatile dresses offer comfort year-round. Breathable fabrics like cotton are especially important for hot, humid summers. In January 2024, Shilpa Shetty launched Zip Zap Zop, a kids' fashion brand featuring comfortable and hypoallergenic clothing.

Breakup by Distribution Channel:

Supermarkets and Hypermarkets

Exclusive Stores

Multi-Brand Retail Outlets

Online

Others

Multi-brand retail outlets acquires the largest share.

Multi-brand outlets (MBOs) are key drivers of India's kids apparel market, offering a wide variety of brands and styles in one place for convenient shopping. MBOs attract busy and budget-conscious parents with promotions, discounts, and seasonal sales. For example, in March 2023, brands like VERO MODA and JACK & JONES opened a multi-brand store in Vaishali Nagar, Jaipur, boosting foot traffic and sales.

Breakup up Gender:

Girls

Boys

India's growing child population is driving steady demand for both girls' and boys' apparel. Traditional attire like lehengas and anarkalis remains popular for girls during special occasions, while boys favor casual western wear like jeans, t-shirts, and shirts for everyday use, blending comfort with style.

Breakup by Region:

North India

East India

West and Central India

South India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, East India, West and Central India, and South India.

North India’s fashion blends traditional and modern styles, with vibrant colors and ethnic prints, adapting to cold winters and hot summers. East India, with its tropical climate, favors traditional Bengali attire like dhoti-kurtas and sarees during festivals, alongside rising demand for casual western wear. In West and Central India, traditional outfits like bandhani, ghagra-cholis, and kurta-pajamas are popular for festivals, while lightweight western wear suits the region’s hot summers and mild winters.

Source - imarc

20. Additional points to read:

Buying Behaviour

• Gifting vs shopping for self: The buying behaviour of consumers in the kids’ wear market varies based on the purpose of the purchase. Gift-giving traditions, such as birthdays and festivals, significantly contribute to brand sales, attracting price-conscious customers with predeȃ ned budgets. Conversely, when parents shop for their children, the focus shifts to high-quality clothing, with price taking a secondary role in the decision-making process.

• Preferences for sets: Customers favour purchasing coordinated sets for their children as it eliminates the need to spend time matching clothes to complete the look. These sets are not only convenient for parents but also cost-efficient, making them a preferred gifting option in terms of clothing.

• Concept of Social Wardrobing: Modern parents, influenced by celebrity and social media trends, are more conscious about dressing their kids. Within the same income and social circles, they aim to ensure that their kids are on par with their peers. On social media, they focus on avoiding the repetition of outȃts to maintain a positive social image.

Source - Imagesbof

Challenges -

• Supply chain difficulties: Managing inventory turnover and minimizing waste in the kids’ wear market is challenging due to the higher quantity and diverse sizes of products. This challenge is intensified by the trend toward fast fashion, which demands quick adaptation to changing styles and trends. Thus, both retailers and manufacturers in the kids’ wear sector face the pressure of efficiently handling inventory and staying agile in response to the dynamic market demands.

• Price sensitivity of consumers: Indian consumers, including parents, are price sensitive. Thus, in the kids’ wear market, where children tend to outgrow clothing rapidly, parents may prioritize cost-effectiveness over brand loyalty.

• Stringent quality concerns: In the highly competitive kids’ wear market, maintaining high-quality standards is essential for building and retaining brand trust since parents are likely to be loyal to brands that consistently deliver durable, safe, and comfortable clothing for children.

Source - Imagesbof

Future Outlook -

As parents continue gaining financial flexibility, their willingness to invest in high-quality and stylish clothing for their children will rise, thereby strongly contributing to the market’s growth. While the arena might seem competitive, brands that continue to innovate their product offerings according to the ever-changing consumer preferences while piquing their interest with creative marketing strategies are likely to succeed.

Source - Imagesbof

Recent Developments -

March 2024: Hopscotch, a destination for children's clothing, launched its first brand campaign. The campaign, with the tagline 'We get kids' fashion,' tried to send a clear message to parents that their children's fashion choices are distinctive and should be celebrated.

February 2024: US Polo Assn, a US-based casualwear brand launched its largest store in Bengaluru, offering a wide variety of kids wear.

January 2024: Mothercare India, a retailer of baby clothing, collaborated with Ed-a-Mamma, a sustainable kids and maternity wear brand. The partnership will benefit customers by offering them a more immersive and interactive in-store shopping experience.

Source - imarc

Thank you for reading till the end! We hope you enjoyed this report.

Researched By- Naresh, Mayank and Vaibhav

All information is sourced from company reports, screener.in, industry reports and Economy Outlook reports.

Disclaimer- We do not recommend buying or selling any stock. You should consult your financial advisor before buying or selling any financial instrument.